zxim

Gold

- Joined

- Jan 12, 2024

- Posts

- 795

- Reputation

- 883

Learn Gamma exposure. And other Greek exposure would help. (High iq calculus for derivative trading)

This doesn’t only apply to options but it also applies to futures trading (normie trading) if you decide to trade intraday which is ideal since you have more volume during regular market hours.

what is gamma exposure?

Basically it tells us where market makers (rich wolf of Wall Street like people) want to move price with positive and negative gamma territory.

seems too good to be true?

Major weakness is major news. In which is constantly happening, in which a mere tweet or TruthSocial post from trump would increase volatility in the market. Gex has an 80-95% win rate from my experience.

I use gexstream.com to see SPX gex especially on Mondays and Fridays which have the most volume (start of week, end of week + shares and options moving together with the futures market).

There’s also Orderflow which is very useful and very worth learning, it tells us what rich dude bought in option contracts telling us where price can move for a company or sp500/nasdaq index, I suggest using cheddarflow or unusual whales to see the data. I don’t want to teach it rn since it might get confusing and too in depth, and I want this to be a short post.

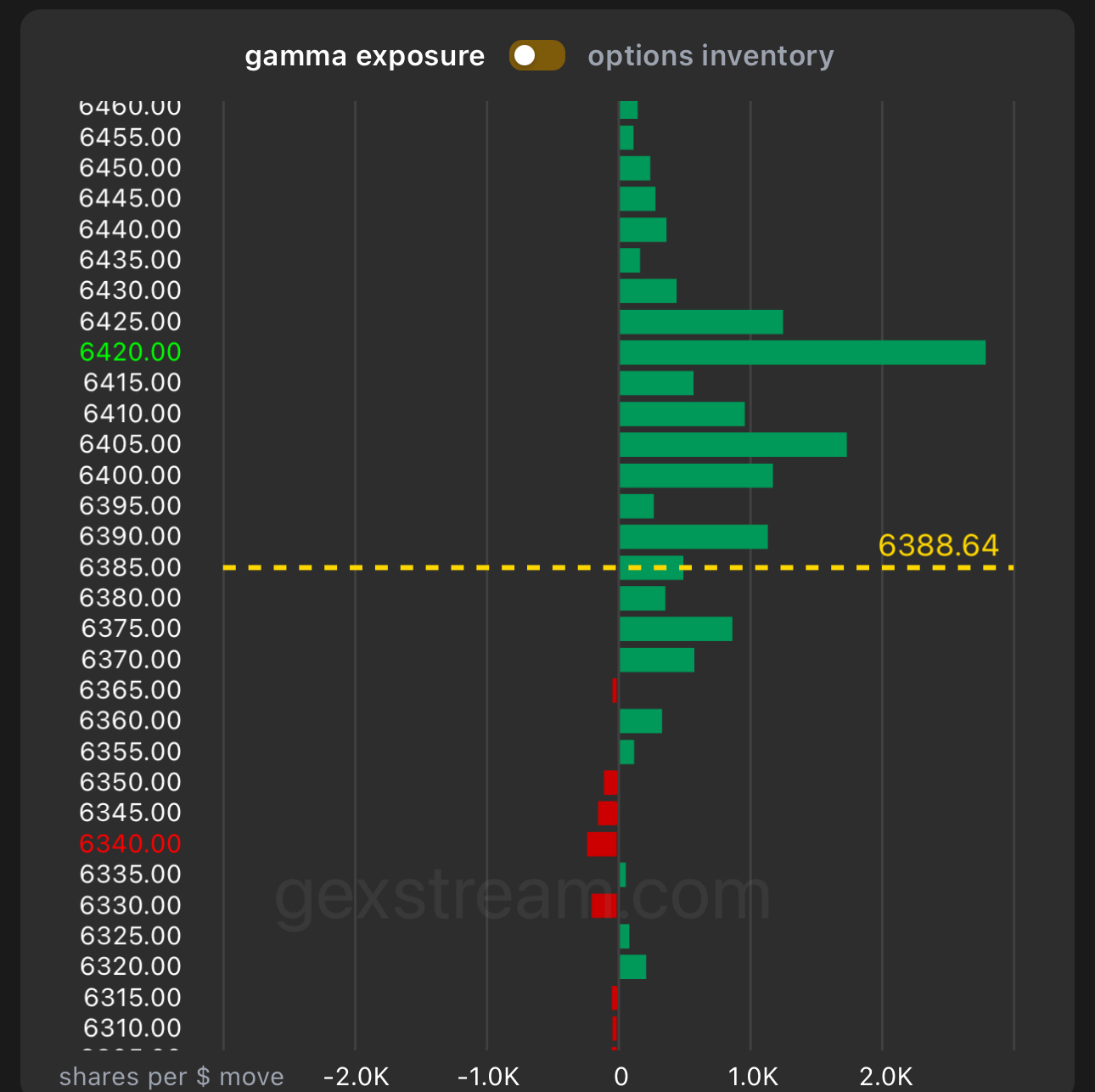

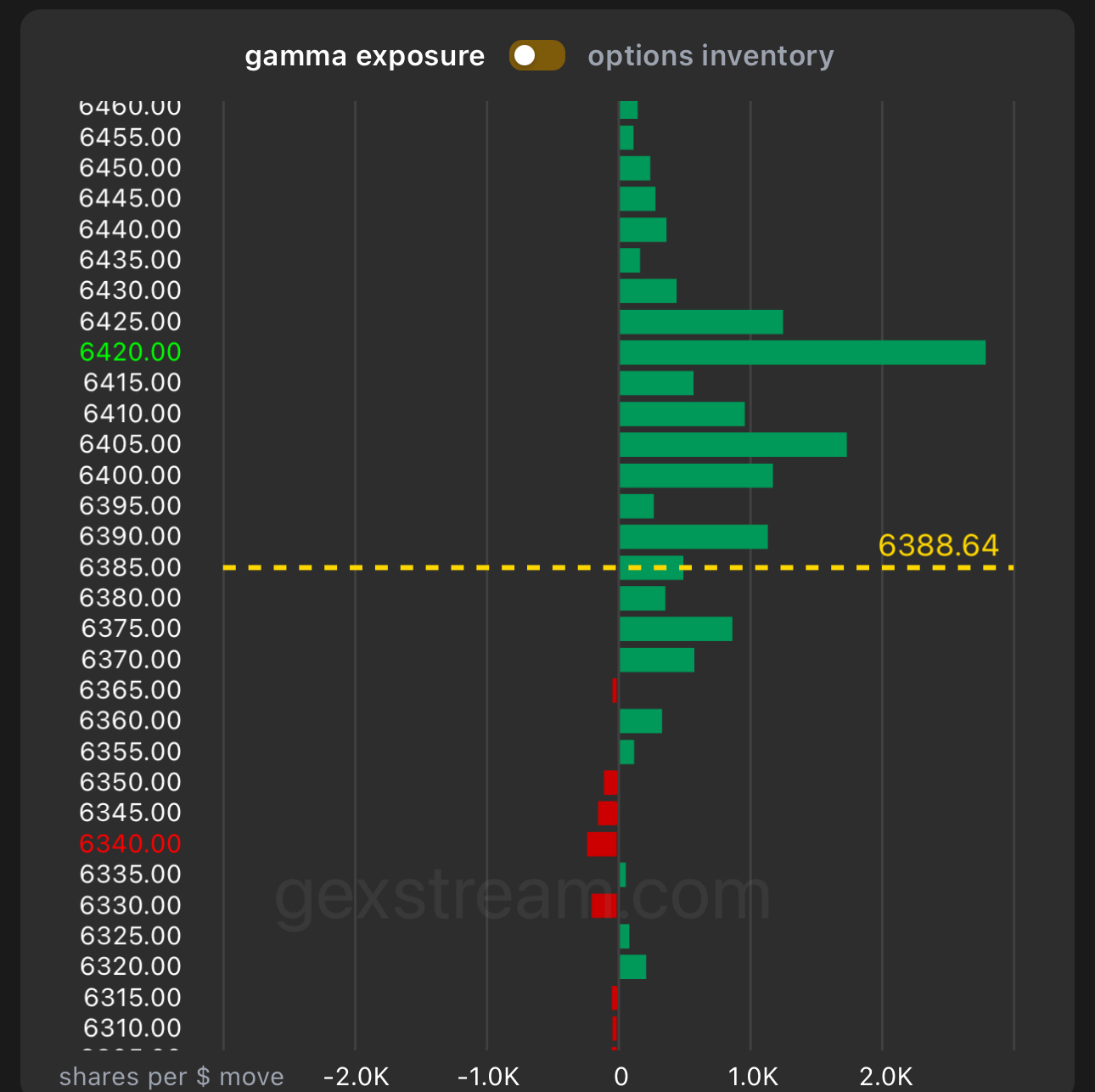

This is a couple of some gamma level charting I did around 1 month ago. I stopped charting on trading view as I just take a quick look at gexstream and place an options trade off of what they show me.

The bigger the green bar, the stronger the magnet it is for price to move to.

Green bar is options Open interest.

I’m tired rn and have work in a few hrs, so this is a shit quality post.

This doesn’t only apply to options but it also applies to futures trading (normie trading) if you decide to trade intraday which is ideal since you have more volume during regular market hours.

what is gamma exposure?

Basically it tells us where market makers (rich wolf of Wall Street like people) want to move price with positive and negative gamma territory.

seems too good to be true?

Major weakness is major news. In which is constantly happening, in which a mere tweet or TruthSocial post from trump would increase volatility in the market. Gex has an 80-95% win rate from my experience.

I use gexstream.com to see SPX gex especially on Mondays and Fridays which have the most volume (start of week, end of week + shares and options moving together with the futures market).

There’s also Orderflow which is very useful and very worth learning, it tells us what rich dude bought in option contracts telling us where price can move for a company or sp500/nasdaq index, I suggest using cheddarflow or unusual whales to see the data. I don’t want to teach it rn since it might get confusing and too in depth, and I want this to be a short post.

This is a couple of some gamma level charting I did around 1 month ago. I stopped charting on trading view as I just take a quick look at gexstream and place an options trade off of what they show me.

The bigger the green bar, the stronger the magnet it is for price to move to.

Green bar is options Open interest.

I’m tired rn and have work in a few hrs, so this is a shit quality post.