Alexanderr

Admin

- Joined

- Mar 5, 2019

- Posts

- 22,471

- Reputation

- 47,955

Original post: https://lookism.net/threads/top-5-looksmaxxing-mistakes-in-my-opinion.500554/post-5210595

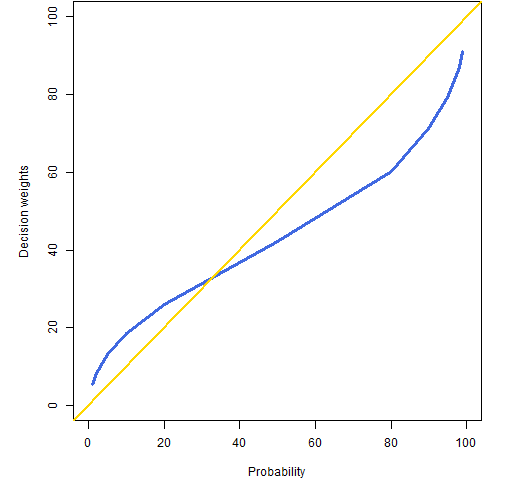

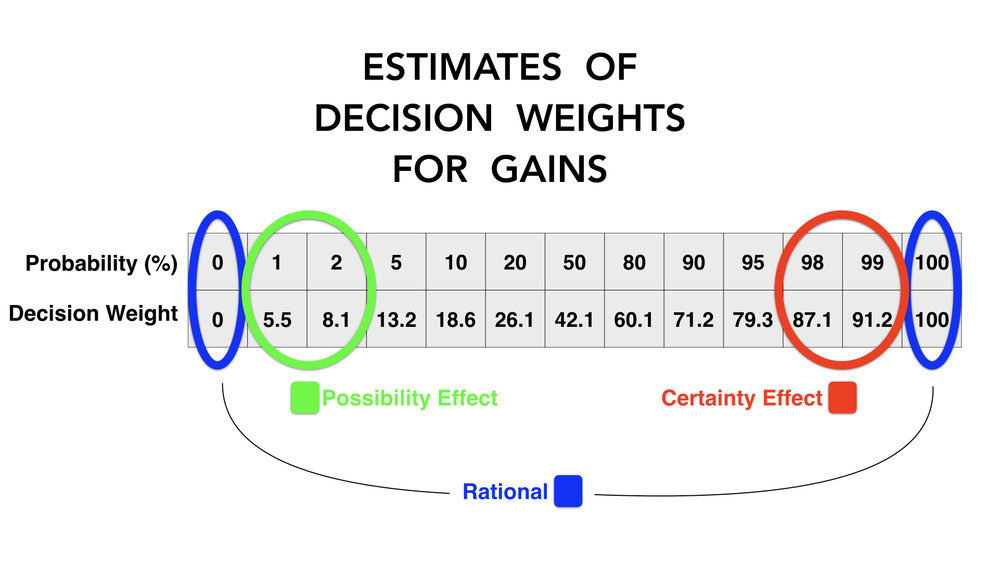

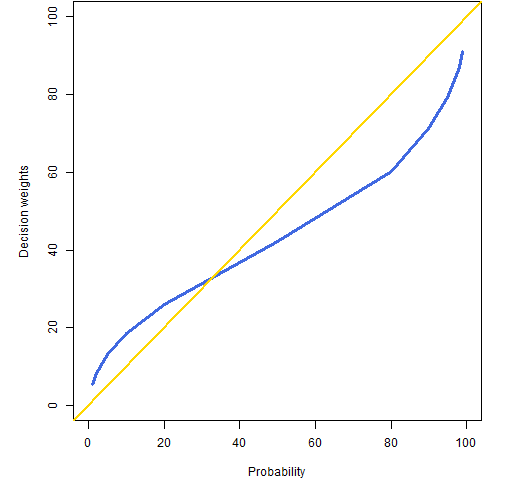

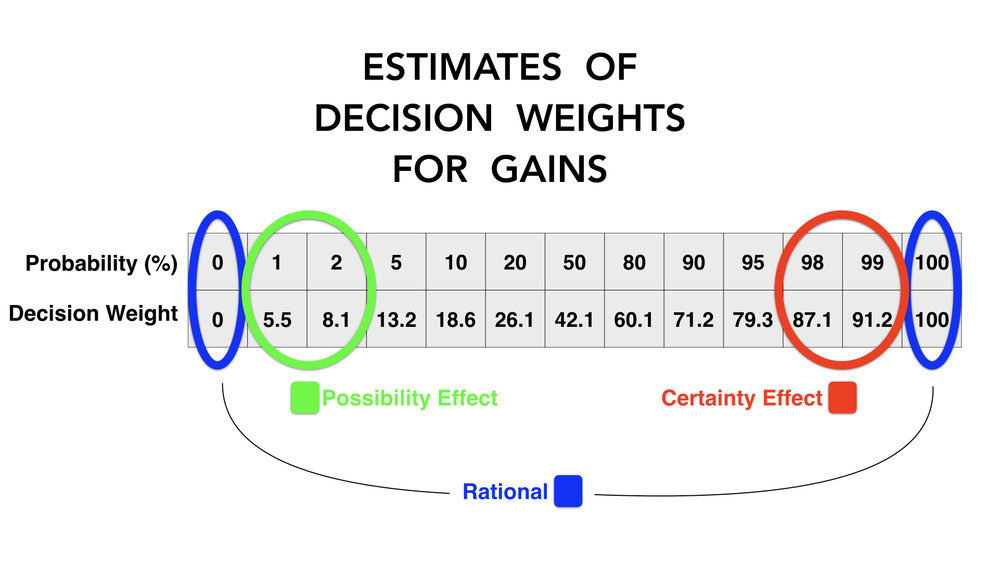

1. We tend to underestimate large/moderate probabilities and to overestimate small probabilities

Why that is is and why our brain is wired that way is another question. Fact is (and we know this from studies) that there is a discrepancy between probability and decision weights (meaning people do not ‘believe’ the stated probabilities, or at least when making decisions they ‘weigh’ probabilities in a manner that is not quite proportional).

Only at the extremes 0 and 100 decision weight and probability are equal, other than that there a difference. Especially close to the extremes as we can see in that table.

So, what does that mean? An example with looksmaxxing:

If the probability of finasteride side effects occurring would be 0, 100% of men who are balding would take finasteride. But what happens now that finasteride side effects occur in 1% of men? You would expect that there is not much big difference between the numbers of men who are willing to take finasteride compared to the scenario where it occurs in 0% of men. Well, as we all know that is not the case. Instead of 100% men who are balding, now only maybe 5% of men are willing to take finasteride and not around 99% as you may expect. The difference between 0% to 1% when it comes to decision making is so drastic and can‘t even be compared to lets the say the difference regarding probability between 49% and 50%.

The same goes for the risk of jaw surgery which is very low but in our neurotic brains gets unproportional weight in the decision making process.

We can observe the same phenomenon in the lottery. If you would ask 100 people if they are willing to play a lottery where the chance of winning is exactly 0%, 0 people would be willing to pay for that bet. But if you tell them there’s a 0,00000072% chance of winning around 20 people would be willing to pay between 2$ and 10$ dollar on it.

It’s just how our brain works. Various reasons and different the explanation for that.

One is called the phenomenon is called the bias of imaginability.

Imaginability plays an important role in the evaluation of probabilities in real-life situations. The risk involved in an adventurous expedition, for example, is evaluated by imagining contingencies with which the expedition is not equipped to cope. If many such difficulties are vividly portrayed, the expedition can be made to appear exceedingly dangerous, although the ease with which disasters are imagined need not reflect their actual likelihood.

Now, what happens if you try to evaluate the risks of finasteride and you read (often made up) stories on propecia‘s effects? Exactly.

The same goes for jaw surgery. One bad example can be enough to fuck with your brain in an unpleasant way. Because now you can imagine it and your brain starts making up causation which could lead to such a result. After your brain is done with this you can read as many statistics as you want the point stands that in your brain the danger will be disproportionately high weight in the decision-making progress. Even worse - now that you read and thought about it, this bad example is very present in your memory.

There are many situations in which people assess the frequency of a class or the probability of an event by the ease with which instances or occurrences can be brought to mind. for example, one may assess the risk of heart attack among middle-aged people by recalling such occurrences among one's acquaintances. Similarly, one may evaluate the probability that a given business venture will fail by imagining various difficulties it could encounter. This judgmental heuristic is called availability. availability is collected by factors other than frequency and probability. consequently, the reliance on availability leads to predictable biases and mistakes in evaluating risks properly.

2. Treating looksmaxxing as a game of possible gains when its actually a game of avoiding losses

Question:

Problem 1: Which do you choose?

Get $900 for sure or a 90% chance to get $1000.

Problem 2: Which do you choose?

Lose $900 for sure or 90% chance to lose $1000.

TLDR: Your brain is shit at evaluating risks especially when it comes to risks that are quite in the low range such as the side effects of finasteride or fucked up surgeries. It gives rare occurrences way too much weight when it comes to making decisions (just like people who play the lottery - yes by avoiding surgery you act as irrational as a lottery player). Being aware of that and acting accordingly is the way to your ascension.

1. We tend to underestimate large/moderate probabilities and to overestimate small probabilities

Why that is is and why our brain is wired that way is another question. Fact is (and we know this from studies) that there is a discrepancy between probability and decision weights (meaning people do not ‘believe’ the stated probabilities, or at least when making decisions they ‘weigh’ probabilities in a manner that is not quite proportional).

Only at the extremes 0 and 100 decision weight and probability are equal, other than that there a difference. Especially close to the extremes as we can see in that table.

So, what does that mean? An example with looksmaxxing:

If the probability of finasteride side effects occurring would be 0, 100% of men who are balding would take finasteride. But what happens now that finasteride side effects occur in 1% of men? You would expect that there is not much big difference between the numbers of men who are willing to take finasteride compared to the scenario where it occurs in 0% of men. Well, as we all know that is not the case. Instead of 100% men who are balding, now only maybe 5% of men are willing to take finasteride and not around 99% as you may expect. The difference between 0% to 1% when it comes to decision making is so drastic and can‘t even be compared to lets the say the difference regarding probability between 49% and 50%.

The same goes for the risk of jaw surgery which is very low but in our neurotic brains gets unproportional weight in the decision making process.

We can observe the same phenomenon in the lottery. If you would ask 100 people if they are willing to play a lottery where the chance of winning is exactly 0%, 0 people would be willing to pay for that bet. But if you tell them there’s a 0,00000072% chance of winning around 20 people would be willing to pay between 2$ and 10$ dollar on it.

It’s just how our brain works. Various reasons and different the explanation for that.

One is called the phenomenon is called the bias of imaginability.

Imaginability plays an important role in the evaluation of probabilities in real-life situations. The risk involved in an adventurous expedition, for example, is evaluated by imagining contingencies with which the expedition is not equipped to cope. If many such difficulties are vividly portrayed, the expedition can be made to appear exceedingly dangerous, although the ease with which disasters are imagined need not reflect their actual likelihood.

Now, what happens if you try to evaluate the risks of finasteride and you read (often made up) stories on propecia‘s effects? Exactly.

The same goes for jaw surgery. One bad example can be enough to fuck with your brain in an unpleasant way. Because now you can imagine it and your brain starts making up causation which could lead to such a result. After your brain is done with this you can read as many statistics as you want the point stands that in your brain the danger will be disproportionately high weight in the decision-making progress. Even worse - now that you read and thought about it, this bad example is very present in your memory.

There are many situations in which people assess the frequency of a class or the probability of an event by the ease with which instances or occurrences can be brought to mind. for example, one may assess the risk of heart attack among middle-aged people by recalling such occurrences among one's acquaintances. Similarly, one may evaluate the probability that a given business venture will fail by imagining various difficulties it could encounter. This judgmental heuristic is called availability. availability is collected by factors other than frequency and probability. consequently, the reliance on availability leads to predictable biases and mistakes in evaluating risks properly.

2. Treating looksmaxxing as a game of possible gains when its actually a game of avoiding losses

Question:

Problem 1: Which do you choose?

Get $900 for sure or a 90% chance to get $1000.

Problem 2: Which do you choose?

Lose $900 for sure or 90% chance to lose $1000.

If you‘re like most people you would have picked the sure win in problem 1 and you would have gambled to avoid the loss in problem 2.

Which in combination makes no sense.

If you look at the expected values of each problem we have the following:

Problem 1:

Option 1: 900*1=900

Option 2: 1000*0,9 = 900

The expected values are the same. The difference is the risk. If you choose option 1 you are risk-friendly if you choose option 2 you are risk-averse.

Problem 2:

Expected values:

Option 1: 900*1 = 900

Option 2: 1000*0,9 = 900

As you can see, it‘s the same problem but the fact that we speak about losses instead of gains changes everything. It completely changed how humans choose and how they react.

Humans treat risks in losses differently than the risk in profits.

Humans who are risk-averse when it comes to gains, all of sudden become risk-friendly when it comes to losses. Why? Because humans regret losses more than they enjoy winnings of the same or similar magnitude. That is why we are ready to pay extra to insure ourselves and that‘s why we suddenly become risk-friendly when it comes to avoiding losses. The pain of losses outweighs our natural risk aversion.

The problem is when it comes to looksmaxxing is that you don't see losses that come with being ugly. You only concentrate on the possible gains (which in most cases won't be enough for you to be willing to take the risk eventually).

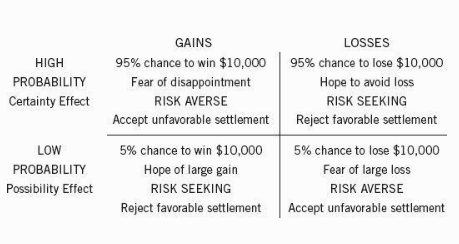

Look at this fourfold pattern. Such schema predicts the feeling and behavior of real humans considering the four combinations of two variables: Probability (high or low) and expected value (gains or losses). In this model, emotions play a very substantial role, powered by risk aversion. It

(The picture above refers to the chance of winning a court trial and the attitude towards an offered settlement in any of the given cases, however it can easily be applied to any other area. e.g. buying a lottery ticket would fall in the lower right field.)

So what does that mean for looksmaxxing?

(The risk of) surgery, as you have seen it until now) falls in the lower right field. This means you will avoid risks when in reality you should understand it as the option in the upper right field (the risk of staying ugly). If you don‘t do anything regarding your looks you will lose in life with high possibility. Misery, pain, regret is almost certain. Once you truly understand and accept this you will eventually be willing to take the risks, to take the steps (whatever it takes) that are needed to achieve your goals.

Right now you may be unhappy or at least not satisfied but it doesn’t have to be that way. Become the master of your fate.

Which in combination makes no sense.

If you look at the expected values of each problem we have the following:

Problem 1:

Option 1: 900*1=900

Option 2: 1000*0,9 = 900

The expected values are the same. The difference is the risk. If you choose option 1 you are risk-friendly if you choose option 2 you are risk-averse.

Problem 2:

Expected values:

Option 1: 900*1 = 900

Option 2: 1000*0,9 = 900

As you can see, it‘s the same problem but the fact that we speak about losses instead of gains changes everything. It completely changed how humans choose and how they react.

Humans treat risks in losses differently than the risk in profits.

Humans who are risk-averse when it comes to gains, all of sudden become risk-friendly when it comes to losses. Why? Because humans regret losses more than they enjoy winnings of the same or similar magnitude. That is why we are ready to pay extra to insure ourselves and that‘s why we suddenly become risk-friendly when it comes to avoiding losses. The pain of losses outweighs our natural risk aversion.

The problem is when it comes to looksmaxxing is that you don't see losses that come with being ugly. You only concentrate on the possible gains (which in most cases won't be enough for you to be willing to take the risk eventually).

Look at this fourfold pattern. Such schema predicts the feeling and behavior of real humans considering the four combinations of two variables: Probability (high or low) and expected value (gains or losses). In this model, emotions play a very substantial role, powered by risk aversion. It

(The picture above refers to the chance of winning a court trial and the attitude towards an offered settlement in any of the given cases, however it can easily be applied to any other area. e.g. buying a lottery ticket would fall in the lower right field.)

So what does that mean for looksmaxxing?

(The risk of) surgery, as you have seen it until now) falls in the lower right field. This means you will avoid risks when in reality you should understand it as the option in the upper right field (the risk of staying ugly). If you don‘t do anything regarding your looks you will lose in life with high possibility. Misery, pain, regret is almost certain. Once you truly understand and accept this you will eventually be willing to take the risks, to take the steps (whatever it takes) that are needed to achieve your goals.

Right now you may be unhappy or at least not satisfied but it doesn’t have to be that way. Become the master of your fate.

TLDR: Your brain is shit at evaluating risks especially when it comes to risks that are quite in the low range such as the side effects of finasteride or fucked up surgeries. It gives rare occurrences way too much weight when it comes to making decisions (just like people who play the lottery - yes by avoiding surgery you act as irrational as a lottery player). Being aware of that and acting accordingly is the way to your ascension.