Jason Voorhees

Say cheese

- Joined

- May 15, 2020

- Posts

- 78,459

- Reputation

- 228,200

Since you niggas like my stock market analysis threads so much let's make another one that is a fairly obvious but important phenomenon that is happening rn which makes for a good case study. Everyone rn is hoarding on gold.

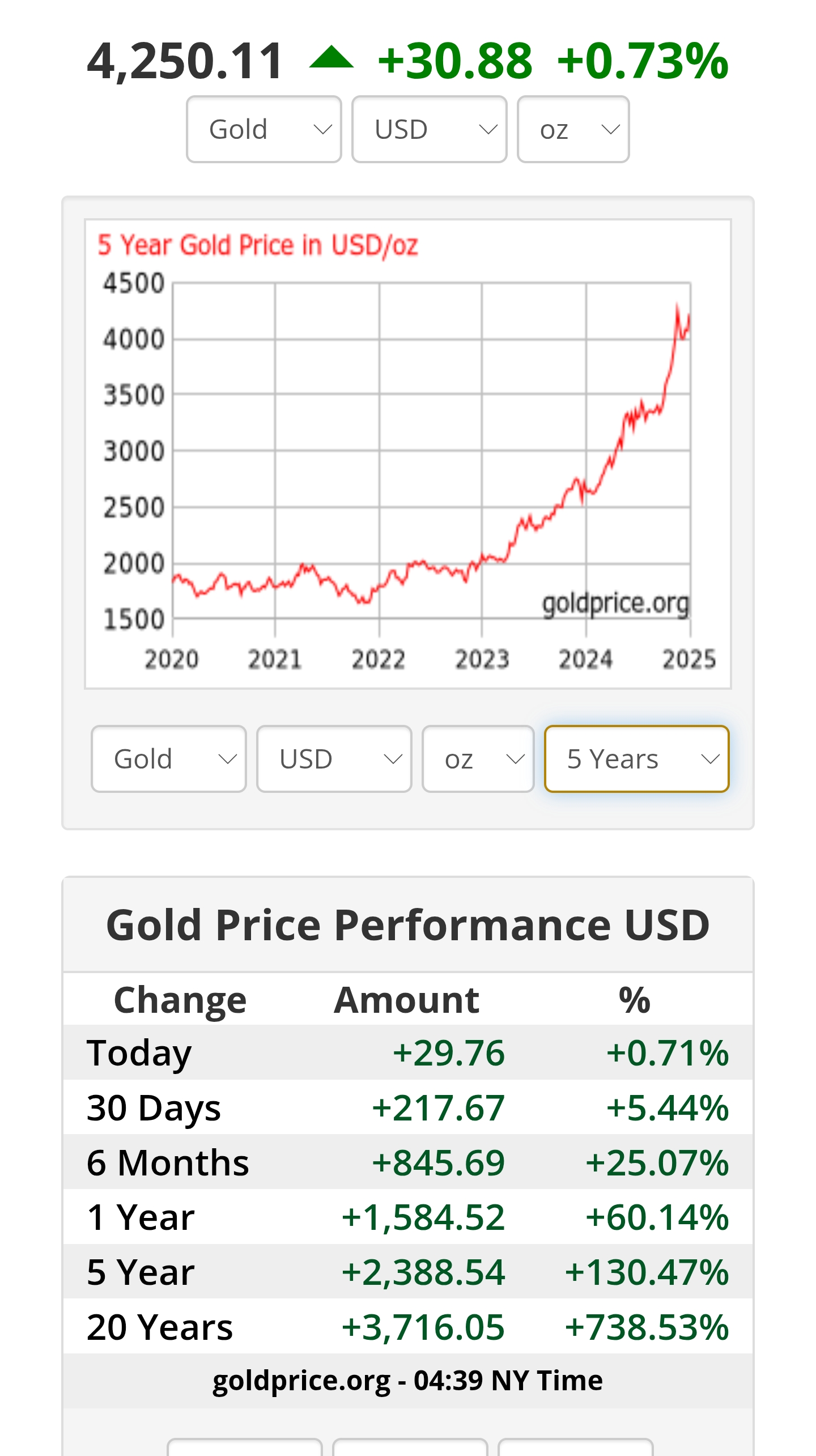

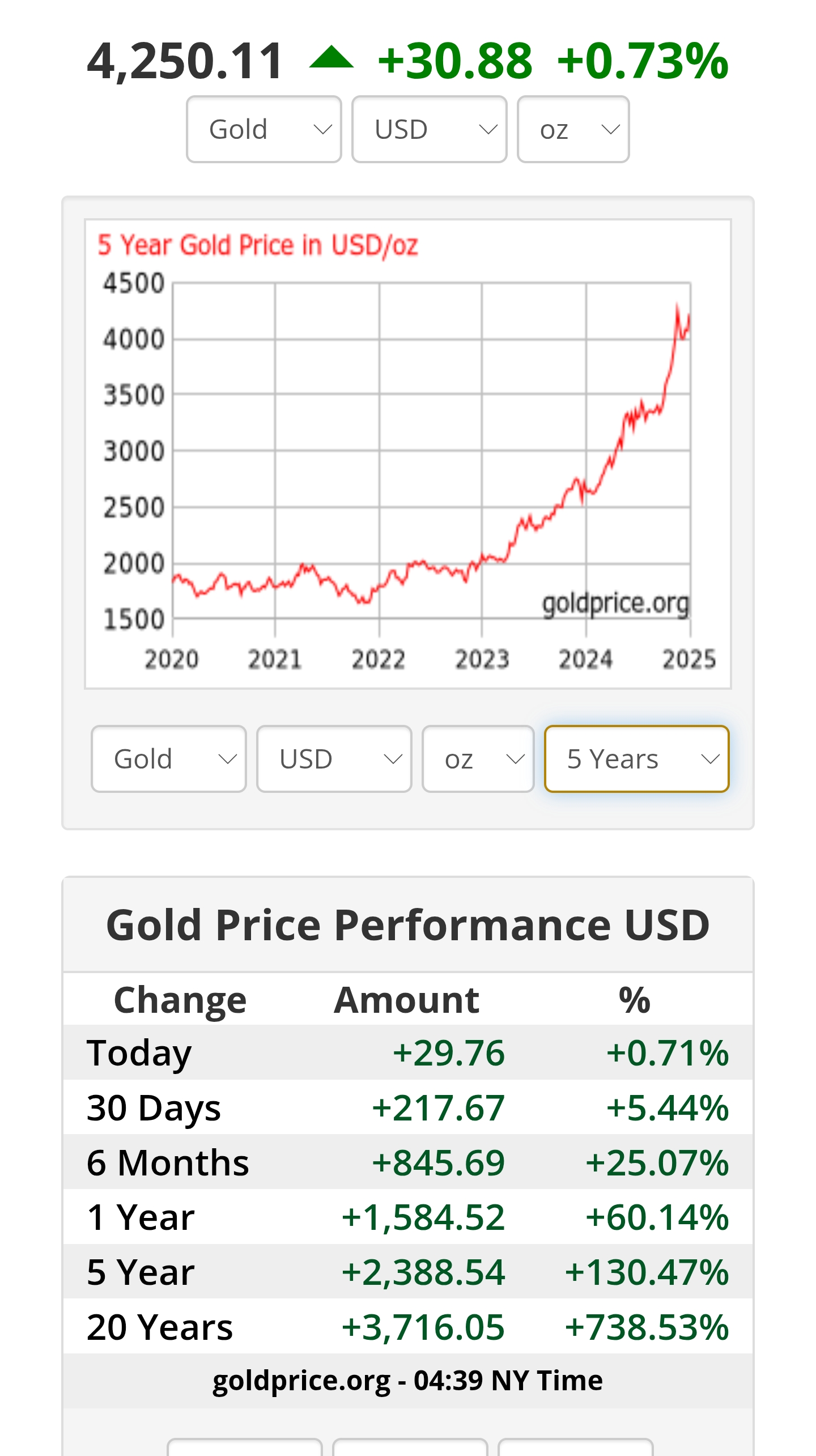

Gold went up by 50% this year

www.investopedia.com

www.investopedia.com

And investors in central bank are rushing to buy more. Why is this the case?

Investors usually all pile into gold when they feel world feels unstable and right now it definitely does

The U.S government has record debt and shutdown. Debt is increasing to insane levels everyday, AI wars are going on in full swing between tech companies with billions of dollars being dumped into the AI bubble, looking at you Google, xAI, OpenAI and Nvidia. Sky high geopolitical tensions which if you didn't know trump's greenlit CIA ops in Venezuela, parked the USS Gerald R. Ford in the Caribbean and straight-up called their airspace closed so it's not just a saber rattling, he's loading the clip so central banks are buying more gold than ever.

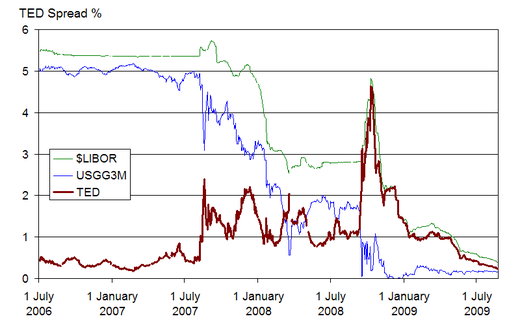

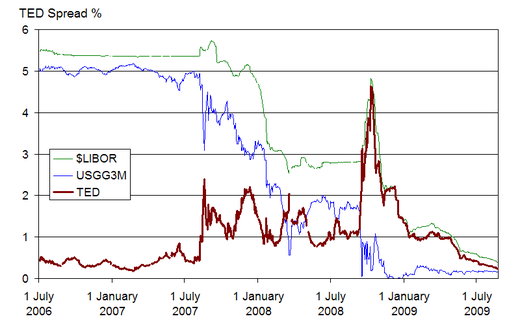

This is because gold is a safe asset compared to paper assets. During the 2008 financial crisis gold nearly doubled while stock markets were crashing

And when inflation spikes between 2020-2022 it hit record highs again while stocks tanked

Gold is considered to be the king to hedge against volatility. It is limited resource that has had value since the beginning of humanity and continues to remain valuable

This is one of main reasons why China and Russia are buying lots of gold. Dumping US treasuries and buying gold as insurance in case there's a market meltdown

www.pgurus.com

www.pgurus.com

www.visualcapitalist.com

www.visualcapitalist.com

Does this mean you need to dump all your money into gold? Ofc not it's more nuanced than that. Gold is a hedge, not an investment strategy. It protects your portfolio when the world goes to hell, but it doesn't grow your wealth on its own. Ir barely beats inflation and stocks outperform it in the long run. So how does a normal investor who doesn't have billions to spare go about this. Always have a 5-15% gold allocation. It protects you during inflation spikes, geopolitical shocks, currency crises etc. Gold is an important asset in everyone portfolio imo. Dont sleep on it. It might save you one day.

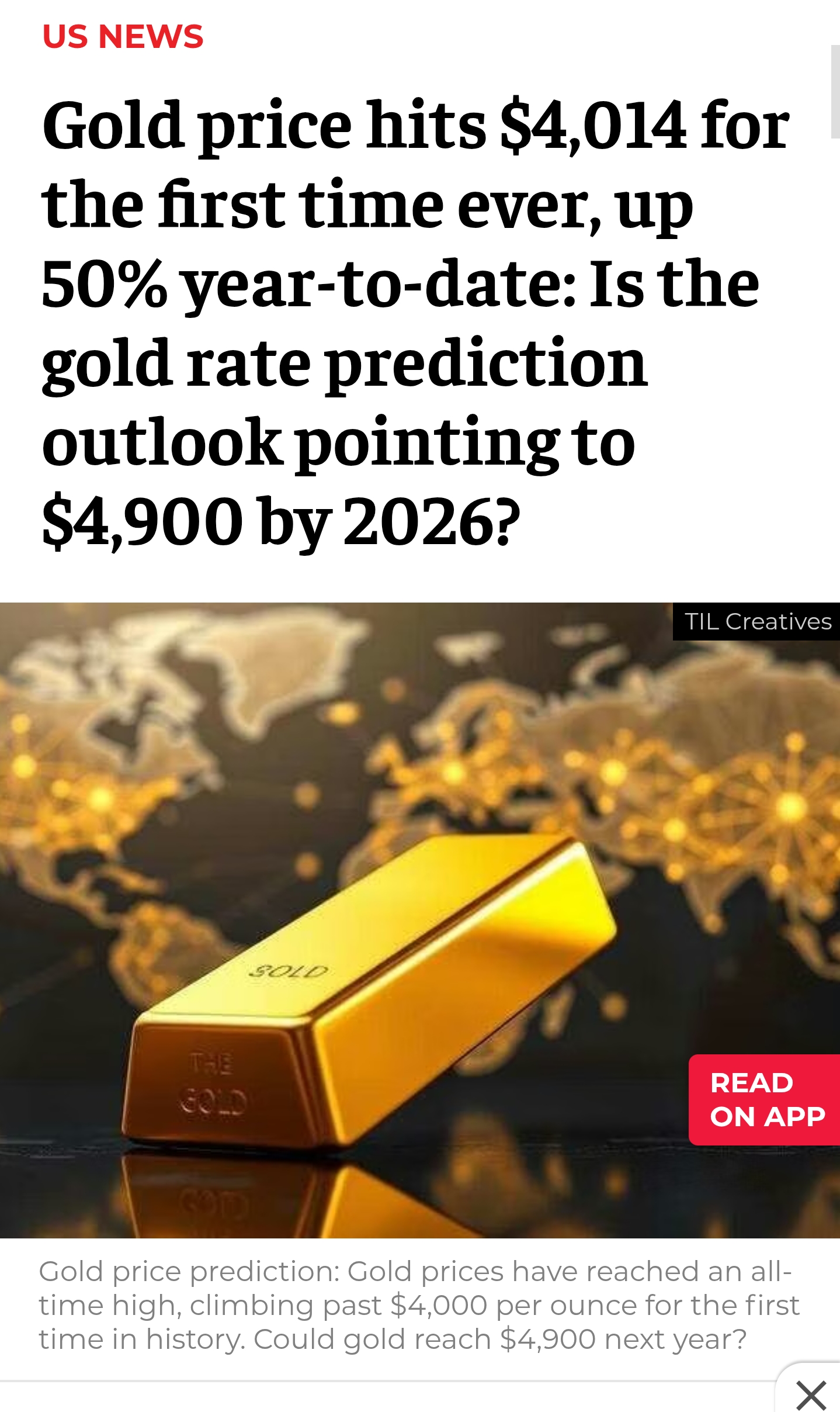

Gold went up by 50% this year

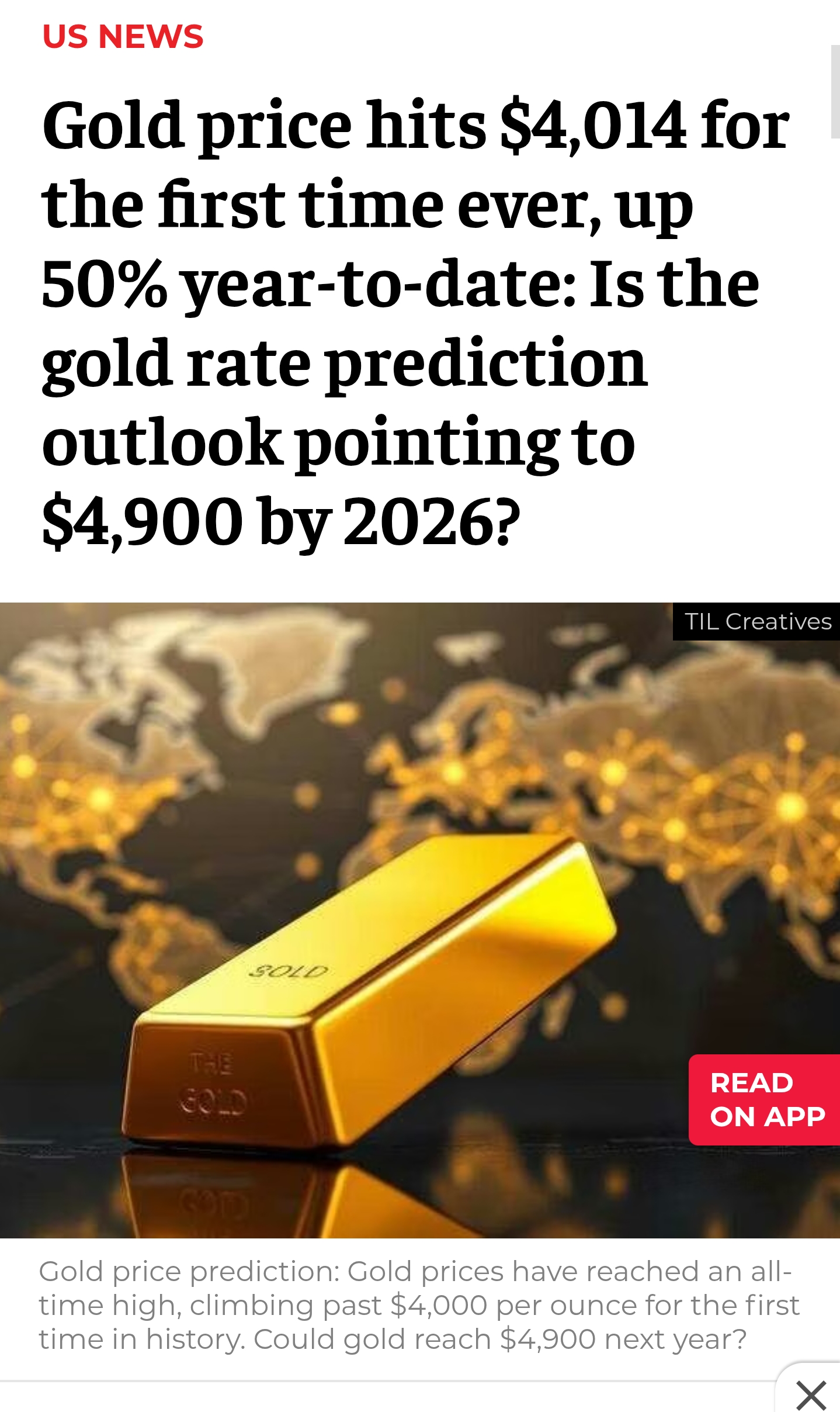

Gold Prices Topped $4,000 For The First Time. Where Do They Go From Here?

Gold hit $4,000 an ounce for the first time on Tuesday and continued to rise on Wednesday, extending its record run amid heightened economic uncertainty and surging interest from everyday investors.

And investors in central bank are rushing to buy more. Why is this the case?

Investors usually all pile into gold when they feel world feels unstable and right now it definitely does

The U.S government has record debt and shutdown. Debt is increasing to insane levels everyday, AI wars are going on in full swing between tech companies with billions of dollars being dumped into the AI bubble, looking at you Google, xAI, OpenAI and Nvidia. Sky high geopolitical tensions which if you didn't know trump's greenlit CIA ops in Venezuela, parked the USS Gerald R. Ford in the Caribbean and straight-up called their airspace closed so it's not just a saber rattling, he's loading the clip so central banks are buying more gold than ever.

This is because gold is a safe asset compared to paper assets. During the 2008 financial crisis gold nearly doubled while stock markets were crashing

And when inflation spikes between 2020-2022 it hit record highs again while stocks tanked

Gold is considered to be the king to hedge against volatility. It is limited resource that has had value since the beginning of humanity and continues to remain valuable

This is one of main reasons why China and Russia are buying lots of gold. Dumping US treasuries and buying gold as insurance in case there's a market meltdown

The Geopolitical Gold Rush: How China and Russia’s Gold Buying Challenges US Dominance

China and Russia’s massive gold purchases are reshaping the world economy and challenging US dollar dominance

www.pgurus.com

www.pgurus.com

Central Banks Now Hold More Gold Than U.S. Treasuries

For the first time since 1996, central banks hold more gold than U.S. Treasuries.

www.visualcapitalist.com

www.visualcapitalist.com

Does this mean you need to dump all your money into gold? Ofc not it's more nuanced than that. Gold is a hedge, not an investment strategy. It protects your portfolio when the world goes to hell, but it doesn't grow your wealth on its own. Ir barely beats inflation and stocks outperform it in the long run. So how does a normal investor who doesn't have billions to spare go about this. Always have a 5-15% gold allocation. It protects you during inflation spikes, geopolitical shocks, currency crises etc. Gold is an important asset in everyone portfolio imo. Dont sleep on it. It might save you one day.

Last edited: