Jason Voorhees

𝕸𝖊𝖗𝖈𝖊𝖓𝖆𝖗𝖞 𝕮𝖔𝖗𝖕 • 𝟐𝟎𝟐𝟒🥇

- Joined

- May 15, 2020

- Posts

- 81,503

- Reputation

- 239,382

I was reading about the Japan situation today and have come to conclusion that it has a worse debt situation than the U.S

Since you niggas love to jerk off to Japan as being self sustaining economy without immigration. I did some research on this and ironically it is exact the reason it is in the situation it is right. It is because it lives in a bubble economy

www.yumeiorigin.com

www.yumeiorigin.com

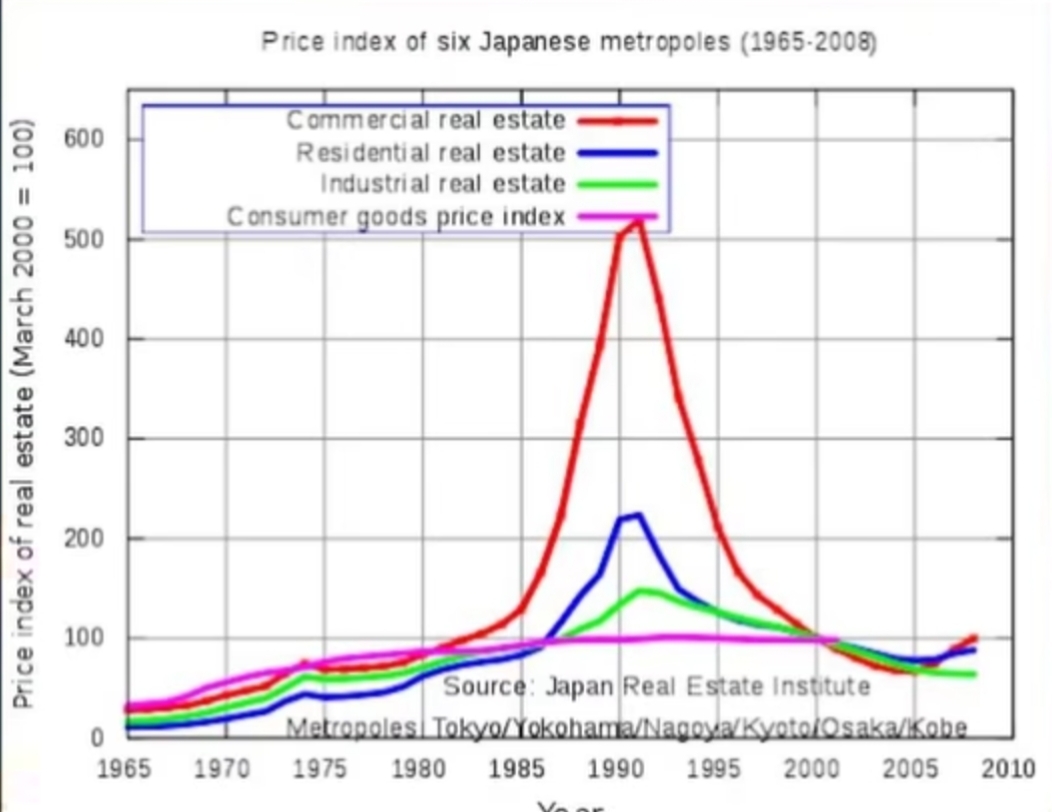

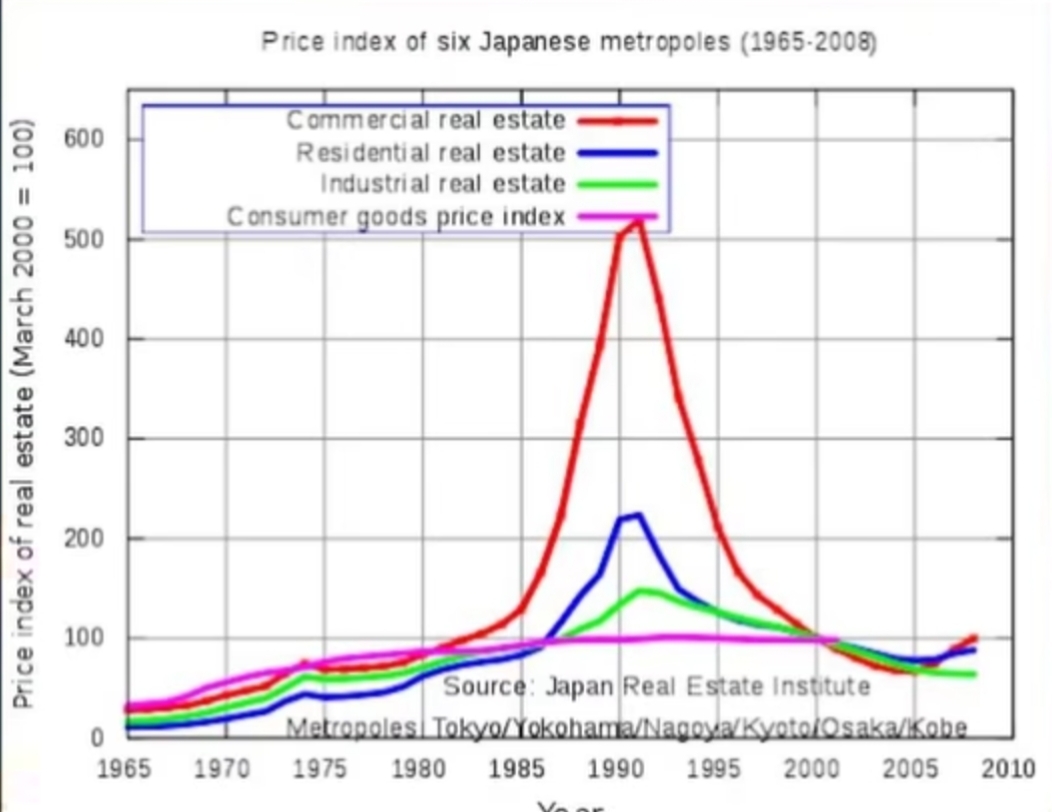

From 1985 1995. Japan pumped out cheap yen. Their money stock grew over 10% every year and interest rates dropped from 5% to 2.5%

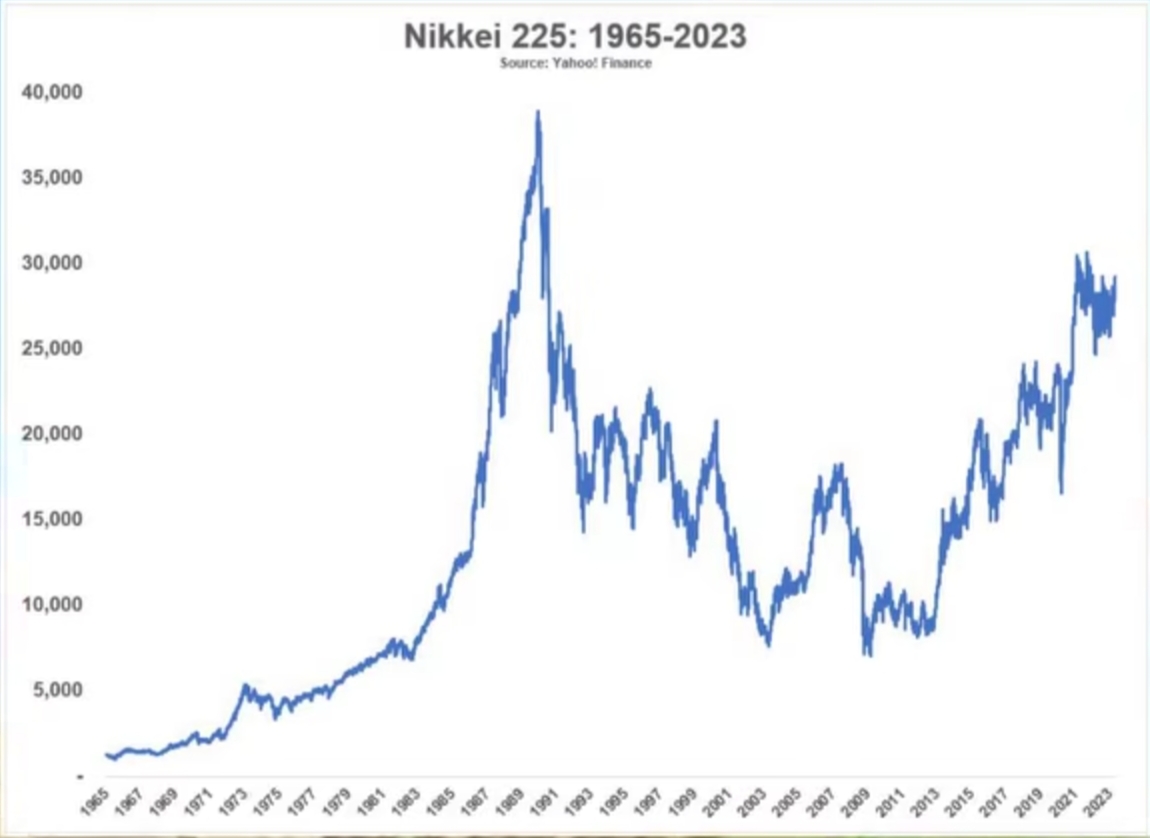

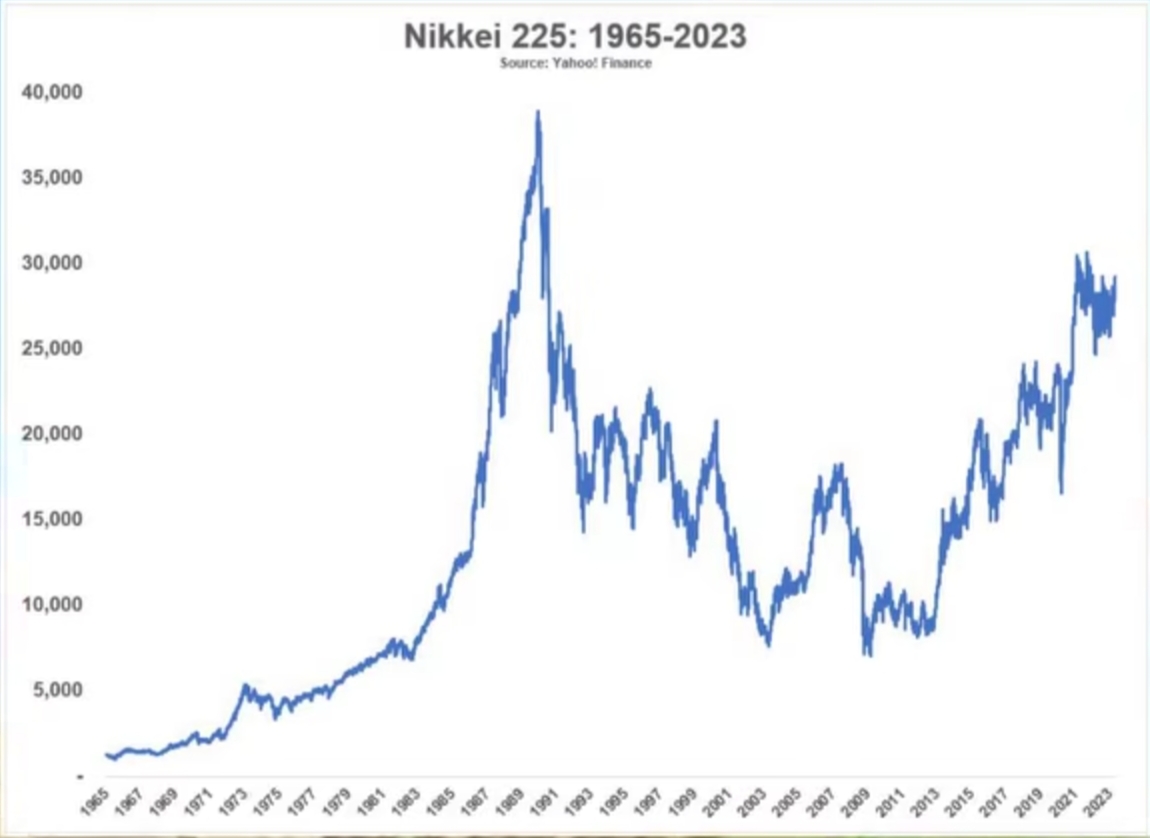

Everyone thus went on a spendinf spree borrowed money buying stocks and land until prices were way higher than reality

And when did this end? The bank of Japan raised rates up to 6% and boom the bubble collapsed overnight and growth bottomlined. everyone panicked and ny 1995 they slashed rates up to 0.5% threw in multiple stimulus packages and bought trillions in commercial paper

Then came something called quantitative easing. They actually invented quantitative easing.

www.investopedia.com

www.investopedia.com

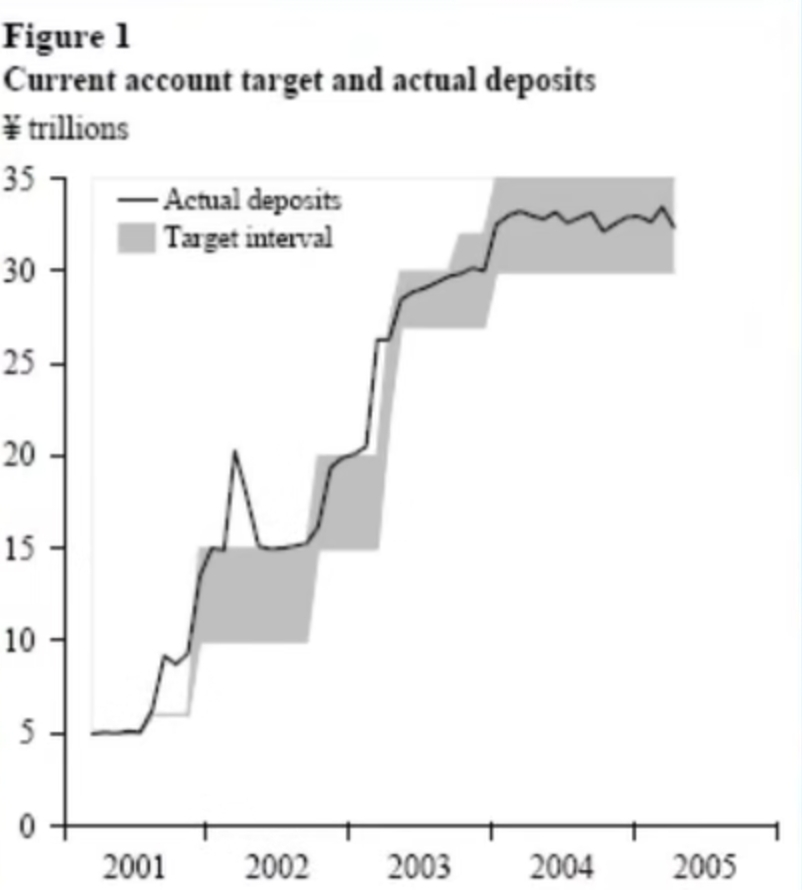

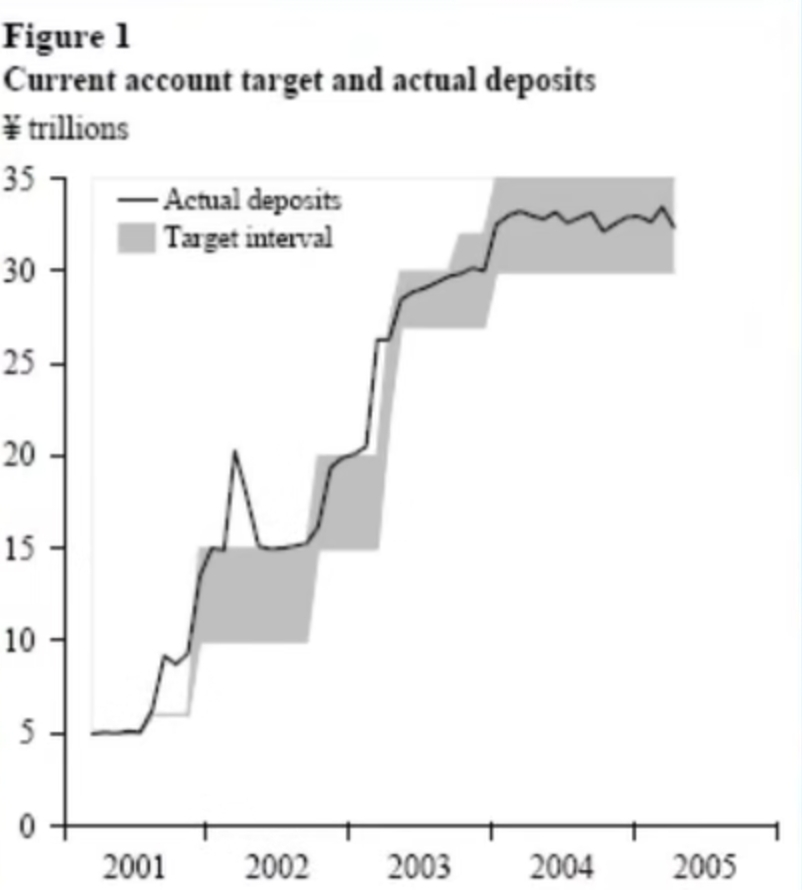

35.5 Trillion yen. Pumped into banks as the Bank of Japan purchased assets from 2001 to 2004. But unfortunately it did not work.

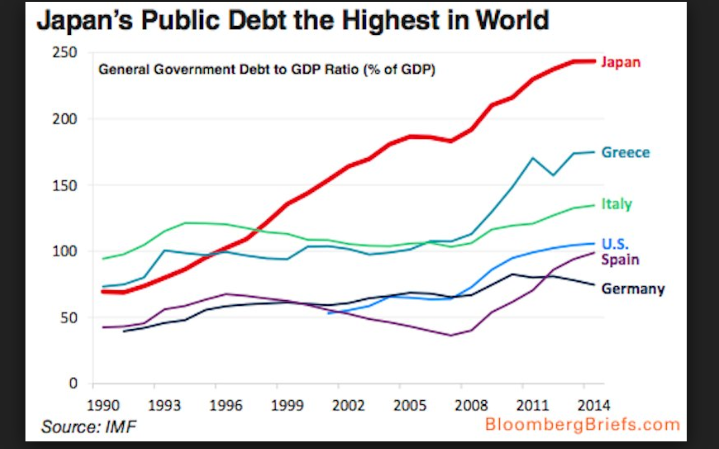

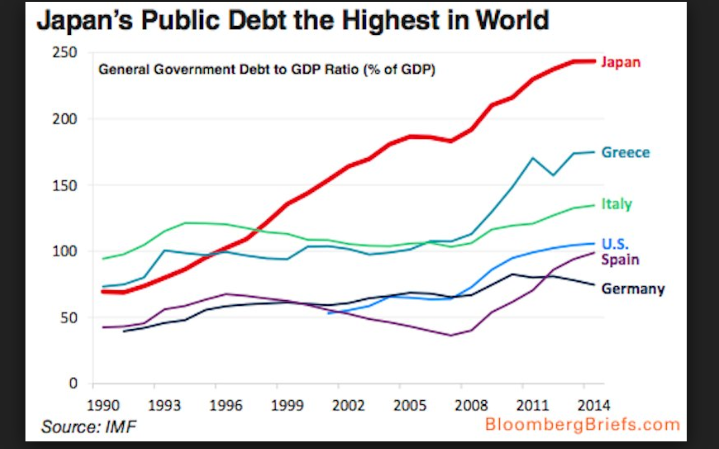

The gap was already too much so in a desperate attempt they launched QQE in 2013 worth a massive 80 trillion yen and QQE2 in 2014 but to no avail. Still no growth and last year their debt to GDP ratio hit 264% highest out of any developed nation.

The only reason it hasn't collapsed is it is because the debt is domestically held and Japan is a high savings society. And they dont have immigration either to bale them out of their Aging population

shrinking workforce problem. It is a ticking time bomb.

US has its own bubbles too like tech, housing etc but diversity keeps the engine running. So Japan is introducing Abenomics 2.0 to finally unfuck themselves and seen some success

What's your take on this?

www.interactivebrokers.com

www.interactivebrokers.com

Since you niggas love to jerk off to Japan as being self sustaining economy without immigration. I did some research on this and ironically it is exact the reason it is in the situation it is right. It is because it lives in a bubble economy

A Glimpse into Japan's Bubble Economy: Wealth and Illusion - ORIGIN

Ever wondered what Japan was like during its wild economic boom? In the late '80s, Japan’s Bubble Economy turned everyday life into a non-stop party of luxury, fast money, and bold ambition—until it all came crashing down. Here’s a look at how it happened, what was gained, and why it still...

www.yumeiorigin.com

www.yumeiorigin.com

From 1985 1995. Japan pumped out cheap yen. Their money stock grew over 10% every year and interest rates dropped from 5% to 2.5%

Everyone thus went on a spendinf spree borrowed money buying stocks and land until prices were way higher than reality

And when did this end? The bank of Japan raised rates up to 6% and boom the bubble collapsed overnight and growth bottomlined. everyone panicked and ny 1995 they slashed rates up to 0.5% threw in multiple stimulus packages and bought trillions in commercial paper

Then came something called quantitative easing. They actually invented quantitative easing.

How Quantitative Easing Spurs Economic Recovery: A Detailed Guide

Discover how quantitative easing works to lower interest rates, boost liquidity, and stimulate economic growth. Learn the pros, cons, and real-world impacts of QE policies.

35.5 Trillion yen. Pumped into banks as the Bank of Japan purchased assets from 2001 to 2004. But unfortunately it did not work.

The gap was already too much so in a desperate attempt they launched QQE in 2013 worth a massive 80 trillion yen and QQE2 in 2014 but to no avail. Still no growth and last year their debt to GDP ratio hit 264% highest out of any developed nation.

The only reason it hasn't collapsed is it is because the debt is domestically held and Japan is a high savings society. And they dont have immigration either to bale them out of their Aging population

shrinking workforce problem. It is a ticking time bomb.

US has its own bubbles too like tech, housing etc but diversity keeps the engine running. So Japan is introducing Abenomics 2.0 to finally unfuck themselves and seen some success

What's your take on this?

Abenomics 2.0? The Case for Reentering Japan’s Equity Market | IBKR Campus US

As Japan prepares for a new prime minister, investors are eyeing a potential revival in growth and undervalued equities.

Last edited: