Jason Voorhees

Say cheese

- Joined

- May 15, 2020

- Posts

- 78,530

- Reputation

- 228,464

Jim Simons and his Renaissance team weren’t financial geniuses. they were the closest thing humanity has ever built to a superintelligence, and they used it to extract $100 billion from the market

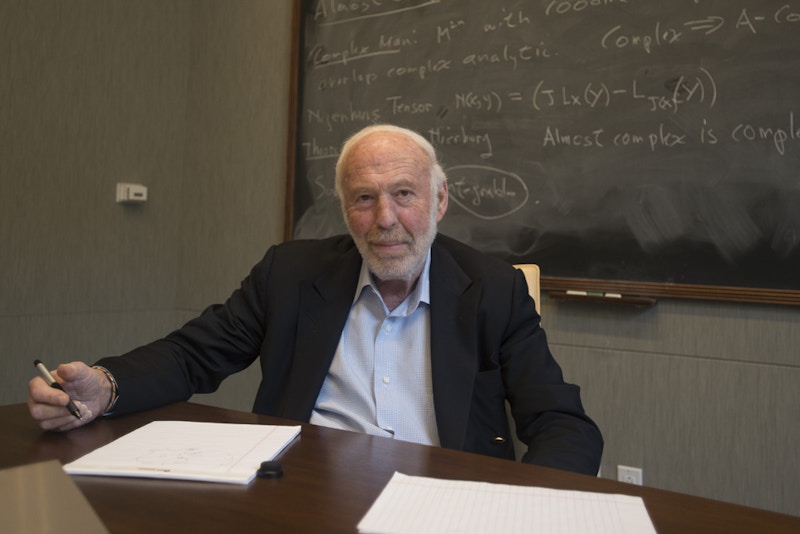

Here's what made him insane. Jim Simons. A born genuis. MIT at 20,PhD in geometry by 23 cracking Soviet codes at the NSA's Institute for Defense. Co-invented the Chern-Simons form, a math breakthrough that underpins string theory and quantum physics But by the '70s, he was bored of academia and gets fired for anti-Vietnam rants and pivoted into finance and burned Wall Street to the ground using pure mathematics..

He created a secretive hive of mathematicians, physicists, top wealth managers and ex-codebreakers turned the market into a solved physics problem. He didn't hire finance bros. Only extremely smart scientists.

Some of the biggest smartest minds in the world. Professors, Scientists and math genuises.

Robert Mercer-PhD in computer science, early pioneer of statistical language modeling at IBM

James Ax - solved problems in logic and number theory that most mathematicians consider unsolvable

Henry Laufer-Mathematician who worked on complex analysis; he built the mathematical backbone of Renaissance.

Ashvin Chhabra: Former head of wealth management at Merrill Lynch and Worked with Renaissance as an advisor/ allocator and pioneered the quant techniques

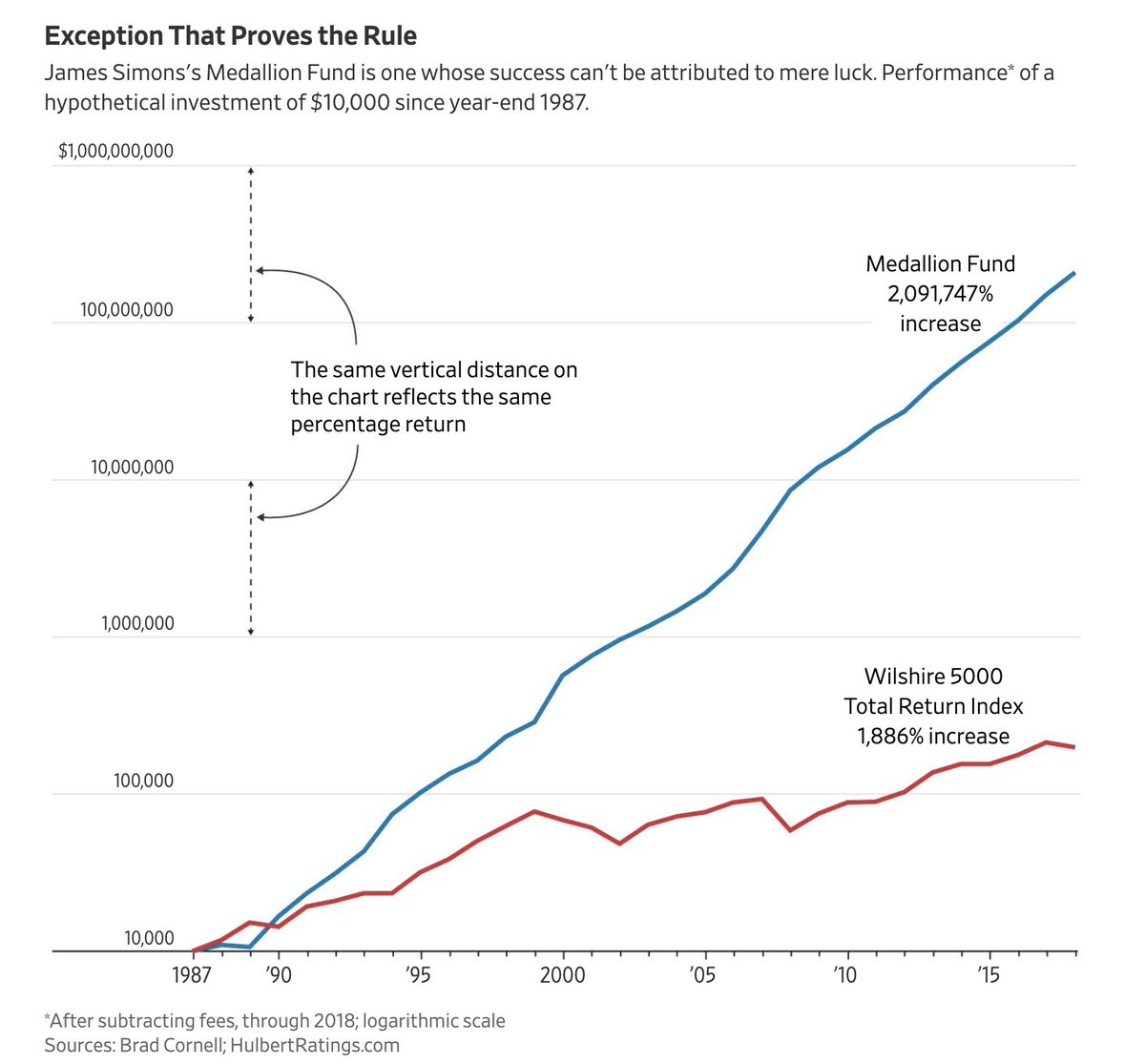

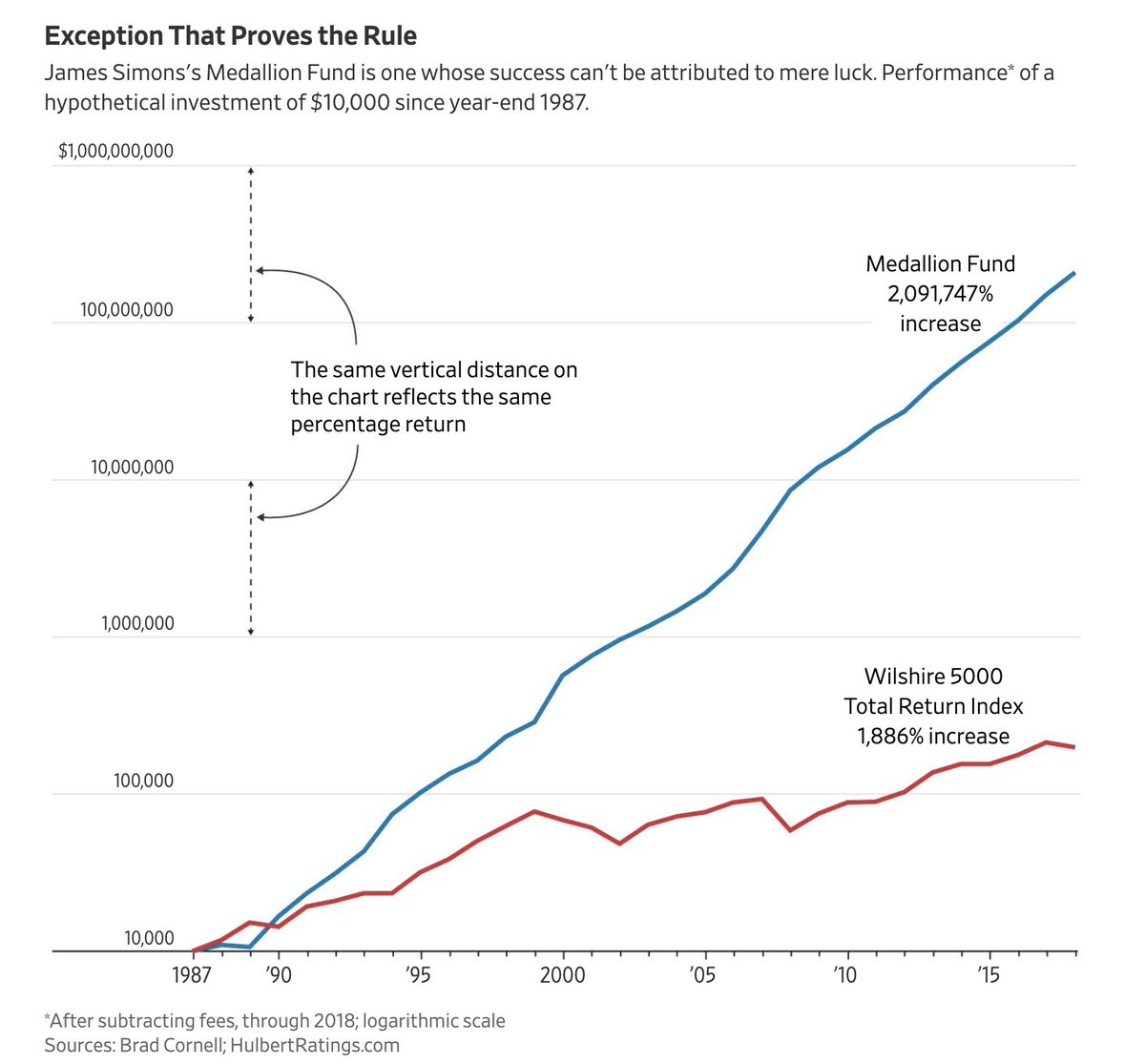

And many more people whose names never got disclosed, while everyone else was still dancing around S&P 500 with 7% returns. Medallion fund had 66% annualized returns for three decades.

Total compounded gain of >100,000%

And with zero drawdowns.

$1 invested in 1988 would be worth more than $20 million today while the same dollar in the S&P 500 would be worth about $25.

It is the single greatest money-making machine in recorded history. Statistically this should not exist. Even with insider trading it is impossible. This is nothing less than miracle.

Competitors genuinely thought they were cheating, using time travel. There were people who legit thought they were communing with demon or using black magic to do this. Everyone whispered, no one knew. No one still knows and all of it was behind a wall of lifelong NDAs and a fund closed to outsiders since 1999. You never had a chance.

The blackpill isn’t that they won it’s that they proved the game is deterministic problem fully solvable then hoarded the solution. The algorithm is still a mystery. Only thing we do know is they used mean reversion, statistical arbitrage and machine learning before it was cool but still No open-source alpha, no trickle down edge, just tax loopholes, political bribes on both sides, and a quiet retirement for the king while his black box keeps printing money even now in 2025. That is real blackpill.The market isn't random.It only feels that way to the rest of us mortals

Here's what made him insane. Jim Simons. A born genuis. MIT at 20,PhD in geometry by 23 cracking Soviet codes at the NSA's Institute for Defense. Co-invented the Chern-Simons form, a math breakthrough that underpins string theory and quantum physics But by the '70s, he was bored of academia and gets fired for anti-Vietnam rants and pivoted into finance and burned Wall Street to the ground using pure mathematics..

He created a secretive hive of mathematicians, physicists, top wealth managers and ex-codebreakers turned the market into a solved physics problem. He didn't hire finance bros. Only extremely smart scientists.

Some of the biggest smartest minds in the world. Professors, Scientists and math genuises.

Robert Mercer-PhD in computer science, early pioneer of statistical language modeling at IBM

James Ax - solved problems in logic and number theory that most mathematicians consider unsolvable

Henry Laufer-Mathematician who worked on complex analysis; he built the mathematical backbone of Renaissance.

Ashvin Chhabra: Former head of wealth management at Merrill Lynch and Worked with Renaissance as an advisor/ allocator and pioneered the quant techniques

And many more people whose names never got disclosed, while everyone else was still dancing around S&P 500 with 7% returns. Medallion fund had 66% annualized returns for three decades.

Total compounded gain of >100,000%

And with zero drawdowns.

$1 invested in 1988 would be worth more than $20 million today while the same dollar in the S&P 500 would be worth about $25.

It is the single greatest money-making machine in recorded history. Statistically this should not exist. Even with insider trading it is impossible. This is nothing less than miracle.

Competitors genuinely thought they were cheating, using time travel. There were people who legit thought they were communing with demon or using black magic to do this. Everyone whispered, no one knew. No one still knows and all of it was behind a wall of lifelong NDAs and a fund closed to outsiders since 1999. You never had a chance.

The blackpill isn’t that they won it’s that they proved the game is deterministic problem fully solvable then hoarded the solution. The algorithm is still a mystery. Only thing we do know is they used mean reversion, statistical arbitrage and machine learning before it was cool but still No open-source alpha, no trickle down edge, just tax loopholes, political bribes on both sides, and a quiet retirement for the king while his black box keeps printing money even now in 2025. That is real blackpill.The market isn't random.It only feels that way to the rest of us mortals

Last edited: