Seth Walsh

The man in the mirror is my only threat

Contributor

- Joined

- Jan 12, 2020

- Posts

- 9,531

- Reputation

- 18,807

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

if i get 100k say from inheritance what should i do to itDon't worry about investing until you have like 25k minimum tbh

What I do is just buy the market and hold forever though

Scale your hustle bigger

same thing for all tbhif i get 100k say from inheritance what should i do to it

what about 250k

500k or 1 million?

thanks

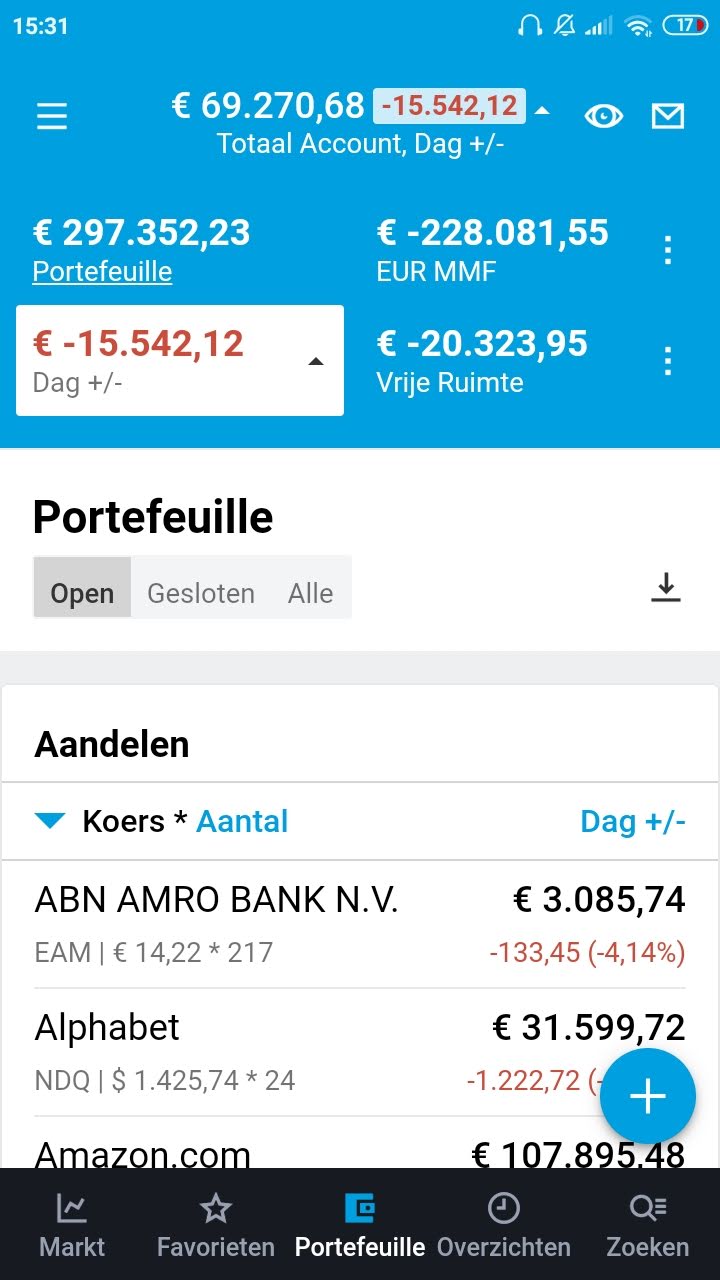

Yeah, I am feeling pretty bad. Today was another huge red day, pretty much lost all gains I've had. If this shit goes on it's over.Fucking brutal.

Corona is causing more suffering, then just people getting seick. You'r then one that's really suffering.

there's abit of fear, i guess:

Fear & Greed Index - Investor Sentiment - CNNMoney

Fear & Greed is CNNMoney's investor sentiment tool that comprises of 7 markets indicators.money.cnn.com

i was betting shorts since last yer November. I had betted about 1500 in turbo shorts. And was at the top around almost wipped out on nearly all my turbo short bets. But now they went back up to a value of 850. So still 650 loss.

welke app is dat en wat doe je precies

i saw.Yeah, I am feeling pretty bad. Today was another huge red day, pretty much lost all gains I've had. If this shit goes on it's over.

What education would you recommend and what should someone stay away from? Also what do you think of working for private militaries?Hey guys, new to forum, got some pms from other thread, people asking about moneymaxxing

My stats:

25-35 yrs old

2-3 million net worth invested in stocks, real estate, crypto. I made 7 figures again in 2019, became a millionaire in 2015

Made significant $ from at least 4 different methods in different fields and friends with tons of rich people so have a lot of general knowledge on investing and making $

My biggest success was from online

I can give unprofessional opinions, these are not investment or career advice

Basically just mention something that makes $ and I'll tell if its bullshit

I would say I'm stressed about higher quality things like how to optimize taxes or how to spend efficientlyAre you happier now that you have all that money? How is your day to day well being?

You mean like what college degree?What education would you recommend and what should someone stay away from? Also what do you think of working for private militaries?

My question for OP: Is copying and pasting ads on clickbank legit or a scam? I see a ton of youtube videos on this moneymaxxing method but I'm skeptical:

I guess they are now pricing in corona-virus slowing economy down?buy the dip

yesIs it time to invest boyos? Market is taking a hit.

too late , too hardThoughts on making money from playing poker?

What are you investing in? I’m about to put some money into cruiselines and airlines and then co diagnostics since they do coronavirus testing.

If you have a 170 IQ mind you can get to the HS within a year, if you are average you have no chance to make a million faster than working in McDonalds if you live in the 1st World.Poker is still literally the best way to go from nothing to 1million dollars , after that there are much better options. Obviously this is only true for people with a specific skill set rather thn iq, i do stake multiple people in poker and i got all of them to make avg income within 6 months, keep in mind they were complete beginners.

Sell stocks buy precious metals ---> wait for the recession ---> sell metals ---> buy stocksLost 45.000 dollars from the highs, barely positive now in total returns lmao, but still positive (friday was also a pretty big red day for me). Still surviving. Another day like yesterday and shit's getting nasty though.

yesterday:

I have had worse in 2018, but if this is just the beginning of of a larger drop it's gonna get bad.

s&pWhat are you investing in? I’m about to put some money into cruiselines and airlines and then co diagnostics since they do coronavirus testing.

You don’t think it’s a good idea to wait until we see a real crash?

What is "real crash" according to you? How is this fake crash?You don’t think it’s a good idea to wait until we see a real crash?

I get it but this is 5 straight days in the red and if there’s a corona virus outbreak in the US, it’ll throw the country into a panic and prices are going to drop a lot more than they have.What is "real crash" according to you? How is this fake crash?

I never get theses people. Everyone wants "the dip" and when "the dip" comes they don't buy, they always want a "bigger dip" lmao

Imo. Don't worry about that. IF you have long investing horizon ahead of you. Even if for example a person bought $100.000 worth of S&P500 index back in in 2007 right before the crash (50% drop, I recall). Which is like the worst timing EVER. He would still have as of today (12 years later) $200.000. Aka, doubled it in 12 years time.I get it but this is 5 straight days in the red and if there’s a corona virus outbreak in the US, it’ll throw the country into a panic and prices are going to drop a lot more than they have.

That’s my mindset too. I’m still making sure I’m putting in money into a retirement fund as well, but I’d be lying if I said I didn’t want to live lavishly while I’m actually young. I’m willing to wait and let my money work for me for 5, even 10 years, but I’m not that concerned about being filthy rich when I’m so old I can barely enjoy what life has to offer anymore. So anything extremely long term isn’t as appealing to me.I am still waiting on the sidelines in cash now, market can drop lower still tbh. Not planning on catching a falling knife. I rather miss the bottom and invest on the way up again. Gonna chill till tuesday or so at least and decide then.

And yeah eduard is right, but I am not investing, I am gambling. I want to get rich by 40yo, not have a well-funded pension when im 70yo.

Buy the fucking dipRIP to all the guys wanting to invest in the markets weeks ago

I need to 0.618 fibonacci retracement technical analysis nerdmaxBuy the fucking dip

You're taking a day-trader approach. When you concern about timing and fibonacci retracement, Moving averages, etc..I need to 0.618 fibonacci retracement technical analysis nerdmax

You're taking a day-trader approach. When you concern about timing and fibonacci retracement, Moving averages, etc..

So, are you a daytrader??

Daytrading only makes sense, imo. If you:

1 . wanna make it your carreer (to be fund manager), and use some small amount of your own money to practise/train with;

2. manage a large amount of your own money AND beat the markets/index

3. Are already as a carreer managing funds of others.

Otherwise. Imo, it's a waiste of time.

I have made above mistake also by the way, so I'm not good/better. I basically suck at stock trading, my results show.. I think most people fail at doing day trading with their own small amount of money (like 20.000). Or maybe some make a little bit of money, it stillsucks becuase if calculate the invested time into hour salary/pay it still sucks.

Generally, if you have some extra time.

It's a saver bet, to use/invest that money, for a side husttle. Like I know some people that are a bit handy, and flip 1-2 cars on the side or one guy he bought a steel cutter machine, and sometimes makes some custom stuff for people that need specialty parts. Etc...

This dude also talked about this. And was pretty correct about it.

dip ?Buy the fucking dip

Don't try to time the dipp perfecty. A 10%-15% dropp, that we have just seen is a decent-good drop/dipp. In the last 10 years, I have only seen a few 10%-15% dropps in this time.dip ?

Hard to say. Most people that beleive they are going to become rich from their $10.000 stock trading acoount, also talk like this. Guys aiming to get like 50% annual returns. I dunno statts, but most that "invest" (read: speculate) that way will lose plenty of money or all money they put in. I lost all $6000 I put in orso also that way in 2014-2015. Aiming with massive margins, to get very high returns/gains, so to get rich that way.I was just joking tbh

shooting for being a millionaire is a "waste of time" imho if u dont have time/sexually frustrated and rushedGetting rich by investing in stocks makes almost nobody rich (besides huge risk takers). New millionaires are all entrepreneurs with highly scalable start ups in fintech or other big market disrupting companies.

e-commerce seems to be the way to go rn, just read internet marketing forums and see what those fuckers are doingIf you became a millionaire in 2015, what's making you a "new money millionaire?" @Moneymaxxed

Just became a millionaire in a valuable currency like the Kuwaiti Dinar? Genuine question; just tryna figure what "new money millionaire" is.

how would go without bs from 0 to 500D/per month to be able to locationmax?e-commerce seems to be the way to go rn, just read internet marketing forums and see what those fuckers are doing

500 a month is extremely easy to achieve brohow would go without bs from 0 to 500D/per month to be able to locationmax?

all these common ideas seem to be either super-saturated or they need to be run for like 2 years to start being profitable

so many ppl on this fourm would slay ie in Asia/SA if they could move there

Thats very solid bro, didn't you lose a lot of money lately if u had stocks? Im not as rich as when I wrote this post lolI am in same boat as you.. But my stats are different and I am poorer than you. 1.5 mil Net worth @ 27 yo. I started selling shit online and invested in stock. I wasted my time studying Genetics to become genetic engineer but left it after feeling FUCKING AWFUL slave. I made more money I'd ever make working at the slave scientist-wannabe job. If I hadn't wasted my time with the study and the slave job, I'd had way more networth.

I believe that cause u are super experienced and already succesful500 a month is extremely easy to achieve bro

can even do that with SEO

Everything is complicated and saturated but $500/mo is a very very low barI believe that cause u are super experienced and already succesful

but when I think SEO I think like: months if not years to get knowledge, complicated and saturated

so if u had gun pointed to your head and would be forced to get to this low barEverything is complicated and saturated but $500/mo is a very very low bar

if u just want something low risk to earn $500 that costs nothing making little SEO niche sites or localized lead capture sites is still a working methodso if u had gun pointed to your head and would be forced to get to this low bar

what would you choose? any hint?

Hey guys, new to forum, got some pms from other thread, people asking about moneymaxxing

My stats:

25-35 yrs old

2-3 million net worth invested in stocks, real estate, crypto. I made 7 figures again in 2019, became a millionaire in 2015

Made significant $ from at least 4 different methods in different fields and friends with tons of rich people so have a lot of general knowledge on investing and making $

My biggest success was from online

I can give unprofessional opinions, these are not investment or career advice

Basically just mention something that makes $ and I'll tell if its bullshit

1. I hate illiquid investments like that so I dont know much other than you should pay attention to the fees and limited sample size of years of performance they haveInterested in real estate; 1) is Fundrise legit)

2) how much startup money would I need to invest in real estate without potentially going into debt?

3) stocks to buy?

Thankful for any help.

make people pay to get unbannedhow can I monetize this forum

1. I hate illiquid investments like that so I dont know much other than you should pay attention to the fees and limited sample size of years of performance they have

2. real estate without leverage is pretty much impossible

3. just buy a cheap s&p500 etf and wait 40 years, you can't beat the market