TheMewingBBC

Fuck PSL

- Joined

- Jul 13, 2019

- Posts

- 1,997

- Reputation

- 6,410

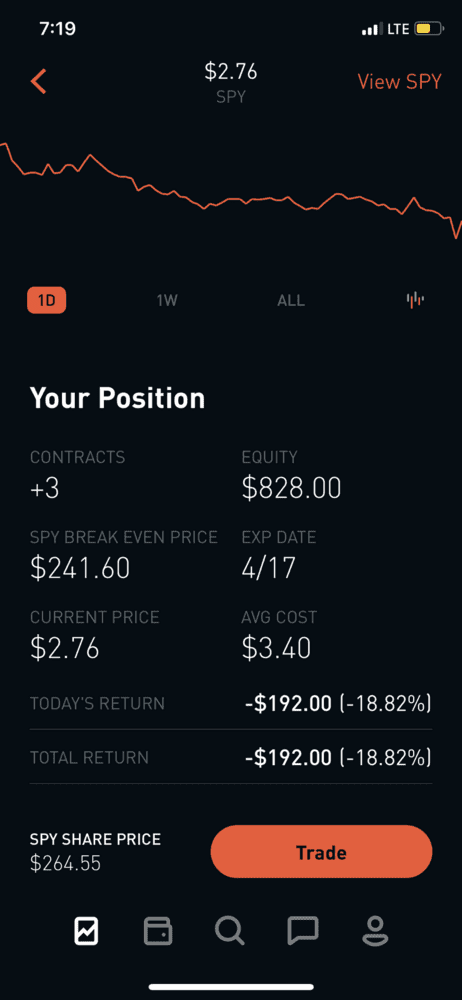

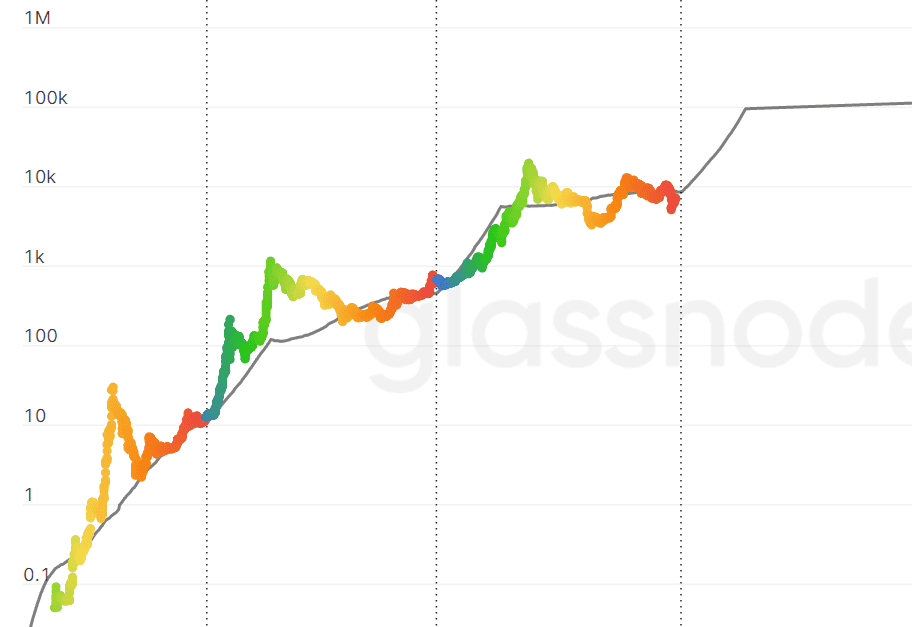

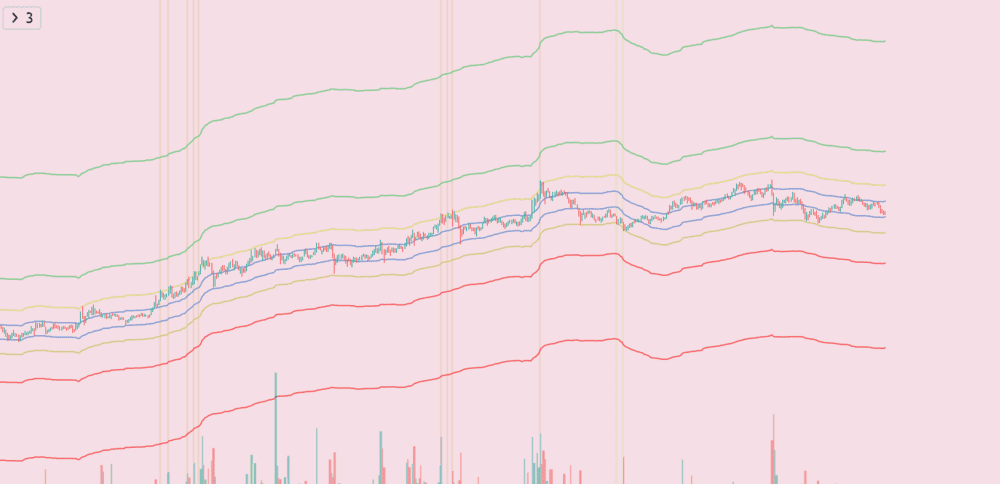

The greatest meme to come out of this sub. Overnight, incels became stocks experts with Dr. Strange tier foresight. They didn't even bother to go with a long straddle or buy calls to sell on a cat bounce, they dump their entire savings and lunch money on SPY poootz even tho speculation was dying and the govt announced unlimited QE because they were smart and know there was absolutely, positively no way it can go tits up. No way.

Now their accounts are bleeding red. Last time they saw something that red was when they were getting pulled from the fragile womb of their post prime Becky mom

Last edited: