D

Deleted member 15778

Luminary

- Joined

- Oct 18, 2021

- Posts

- 7,290

- Reputation

- 9,523

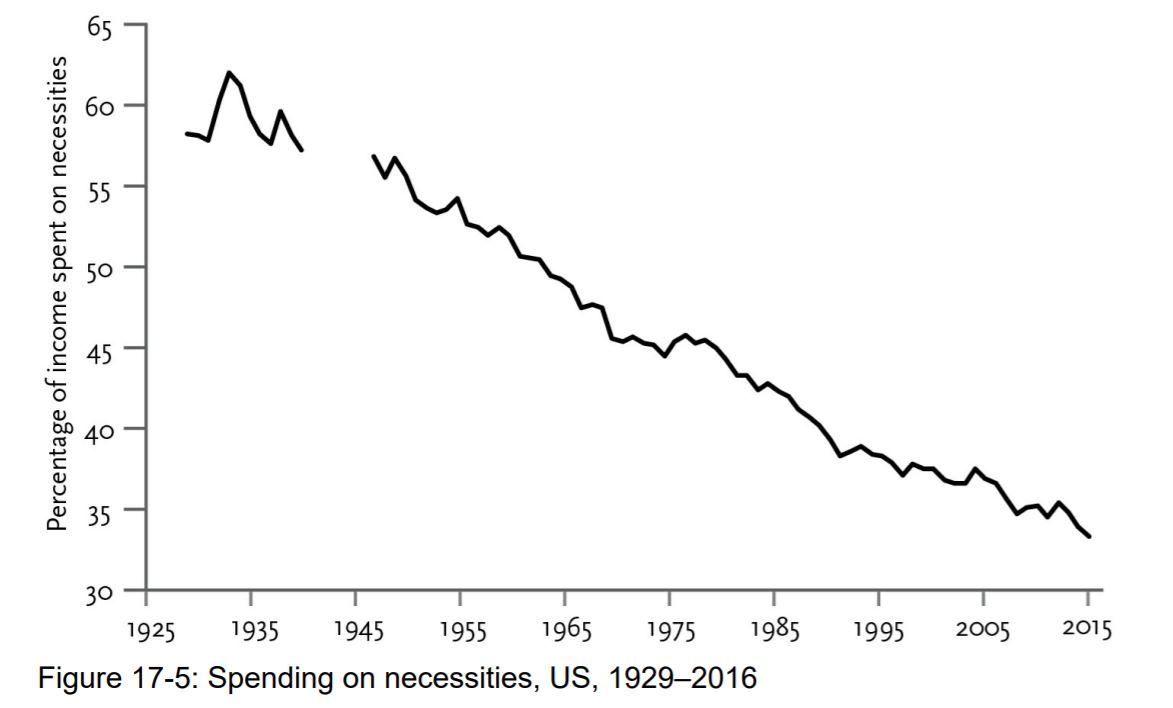

So... apparently before inflation the average stock market returns are 10%. I believe that's with dividend reinvestment.

www.nerdwallet.com

www.nerdwallet.com

But according to this analysis (below) the government changed how they calculate inflation, so that they could spend less money on social security and other expenses and print more more money. They actually changed it several times, each time trying to make the official inflation numbers lower.

www.shadowstats.com

www.shadowstats.com

But looking at the graph here, the actual annual inflation looks to be about 10% average using the original 1980s inflation calculation before politicians had it changed to help hide their money printing and lower social security costs.

www.shadowstats.com

www.shadowstats.com

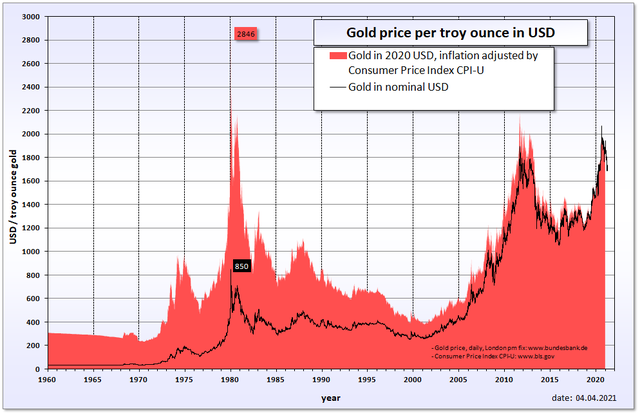

This means that the actual stock market has on average (after calculating for inflation) zero percent returns, it's just an inflation hedge like gold. This might also mean the economy is not growing it's just an illusion caused by money printing and faulty government stats.

Average stock market return for the last 20 years is 7.45% before adjusting for inflation, which would be a negative real return after adjusting for inflation. So the actual stock market is a shrinking pool of value, possible, and sub-optimal place to put money even when diversified in an index fund.

This could be because the economy is actually shrinking in reality?

Or possible money is being moved out of the stock market into other inflation hedges such as gold, bitcoin, bonds, or some other weird thing? I'm not sure where it's going.

Anyways, High IQ Cels, am I on to something or is this all a bunch of bullshit?

The Average Stock Market Return: About 10% - NerdWallet

The average stock market return over the long term is about 10% annually. That's what buy-and-hold investors have historically earned before inflation.

But according to this analysis (below) the government changed how they calculate inflation, so that they could spend less money on social security and other expenses and print more more money. They actually changed it several times, each time trying to make the official inflation numbers lower.

No. 515�PUBLIC COMMENT ON INFLATION MEASUREMENT AND THE CHAINED-CPI (C-CPI)

But looking at the graph here, the actual annual inflation looks to be about 10% average using the original 1980s inflation calculation before politicians had it changed to help hide their money printing and lower social security costs.

Alternate Inflation Charts

This means that the actual stock market has on average (after calculating for inflation) zero percent returns, it's just an inflation hedge like gold. This might also mean the economy is not growing it's just an illusion caused by money printing and faulty government stats.

Average stock market return for the last 20 years is 7.45% before adjusting for inflation, which would be a negative real return after adjusting for inflation. So the actual stock market is a shrinking pool of value, possible, and sub-optimal place to put money even when diversified in an index fund.

This could be because the economy is actually shrinking in reality?

Or possible money is being moved out of the stock market into other inflation hedges such as gold, bitcoin, bonds, or some other weird thing? I'm not sure where it's going.

Anyways, High IQ Cels, am I on to something or is this all a bunch of bullshit?