Jason Voorhees

Say cheese

- Joined

- May 15, 2020

- Posts

- 79,846

- Reputation

- 233,180

The U.S according to many experts is entering it's final super cycle. It's peaking right before the fatal fall

ninetyone.com

ninetyone.com

tradersummit.net

tradersummit.net

It has dominated and been the definitive currency of world trade for almost a century now but everyone's now quitely preparing for life after it. In a few years it might be the end of it because of Mr. Trumps brilliant policies

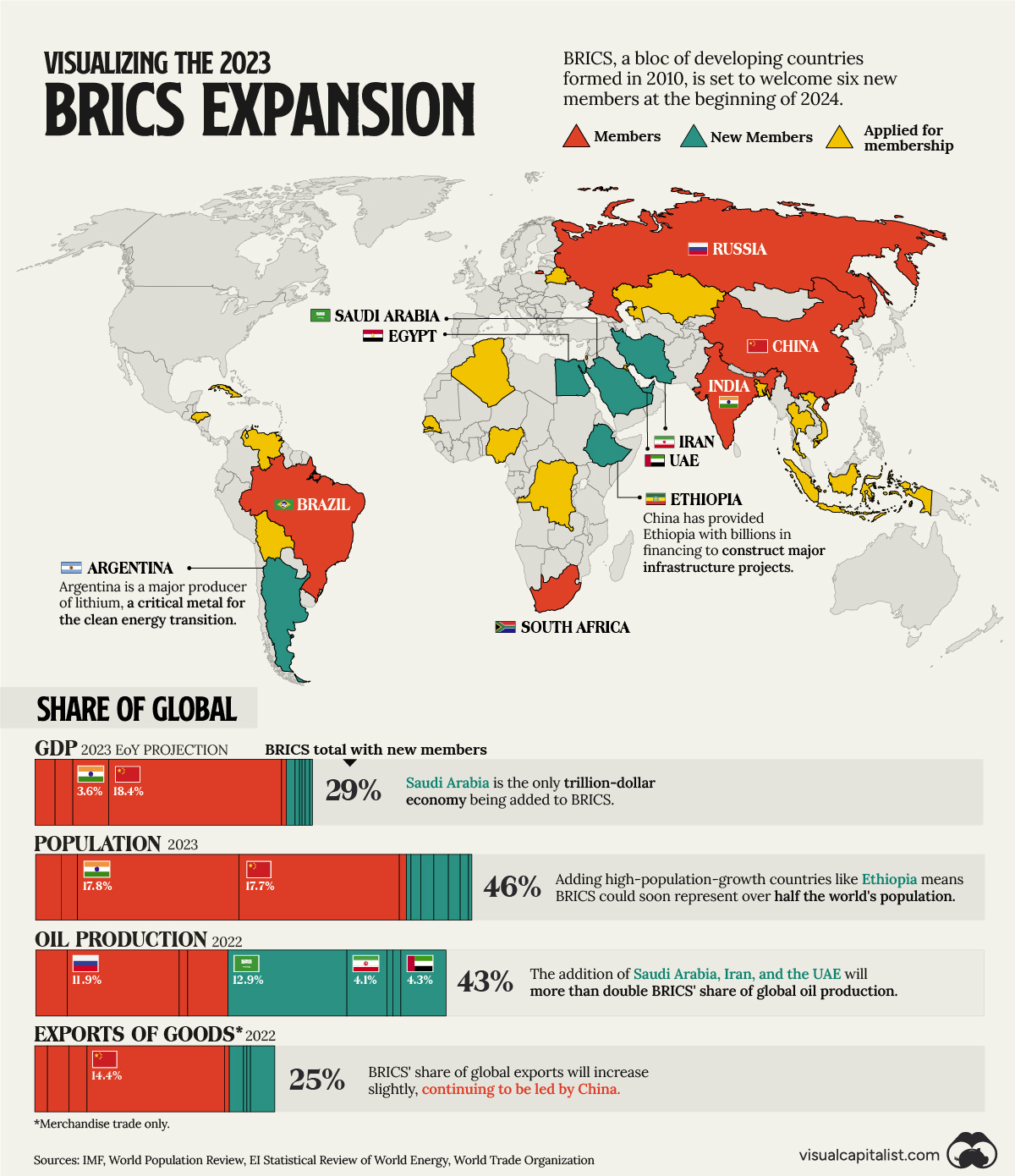

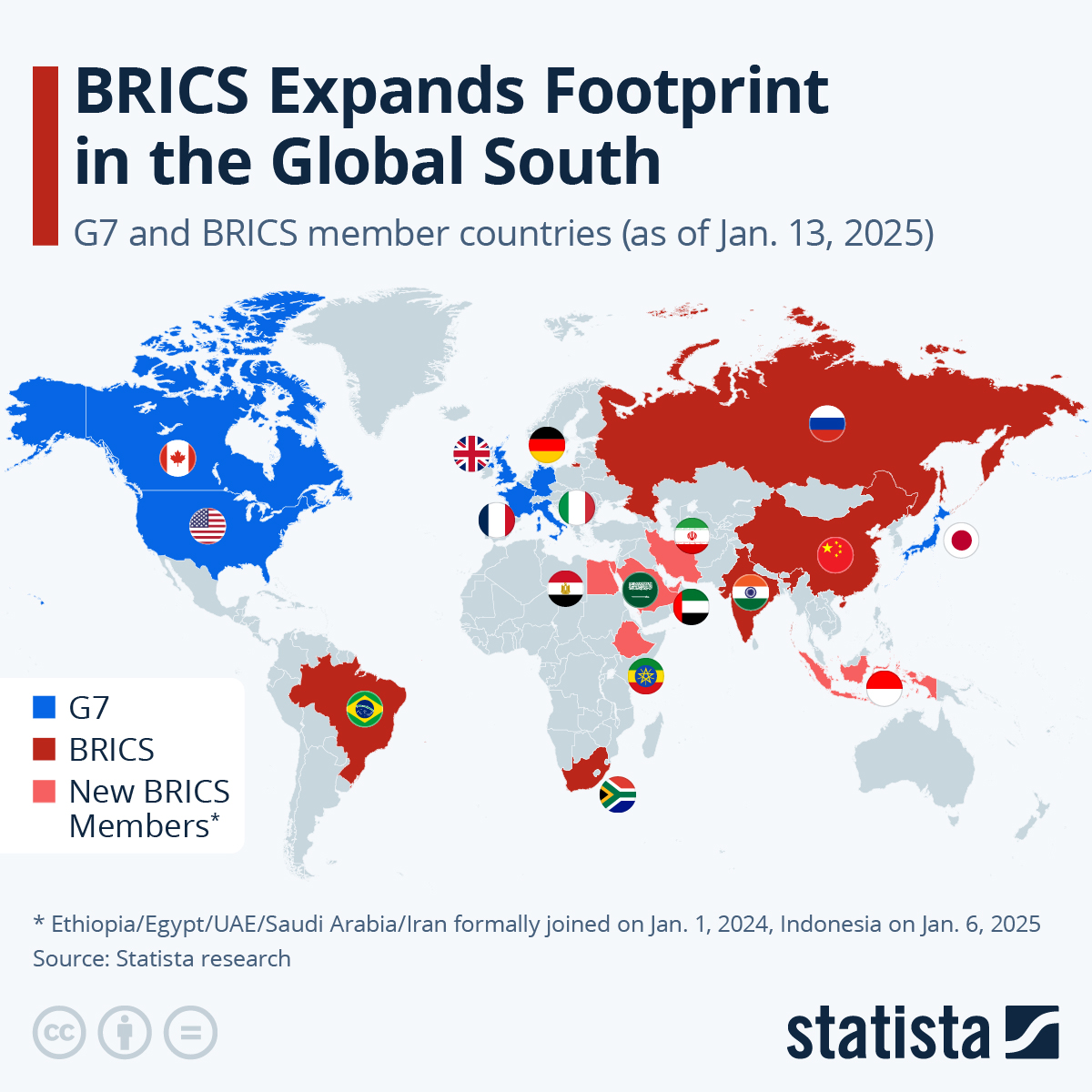

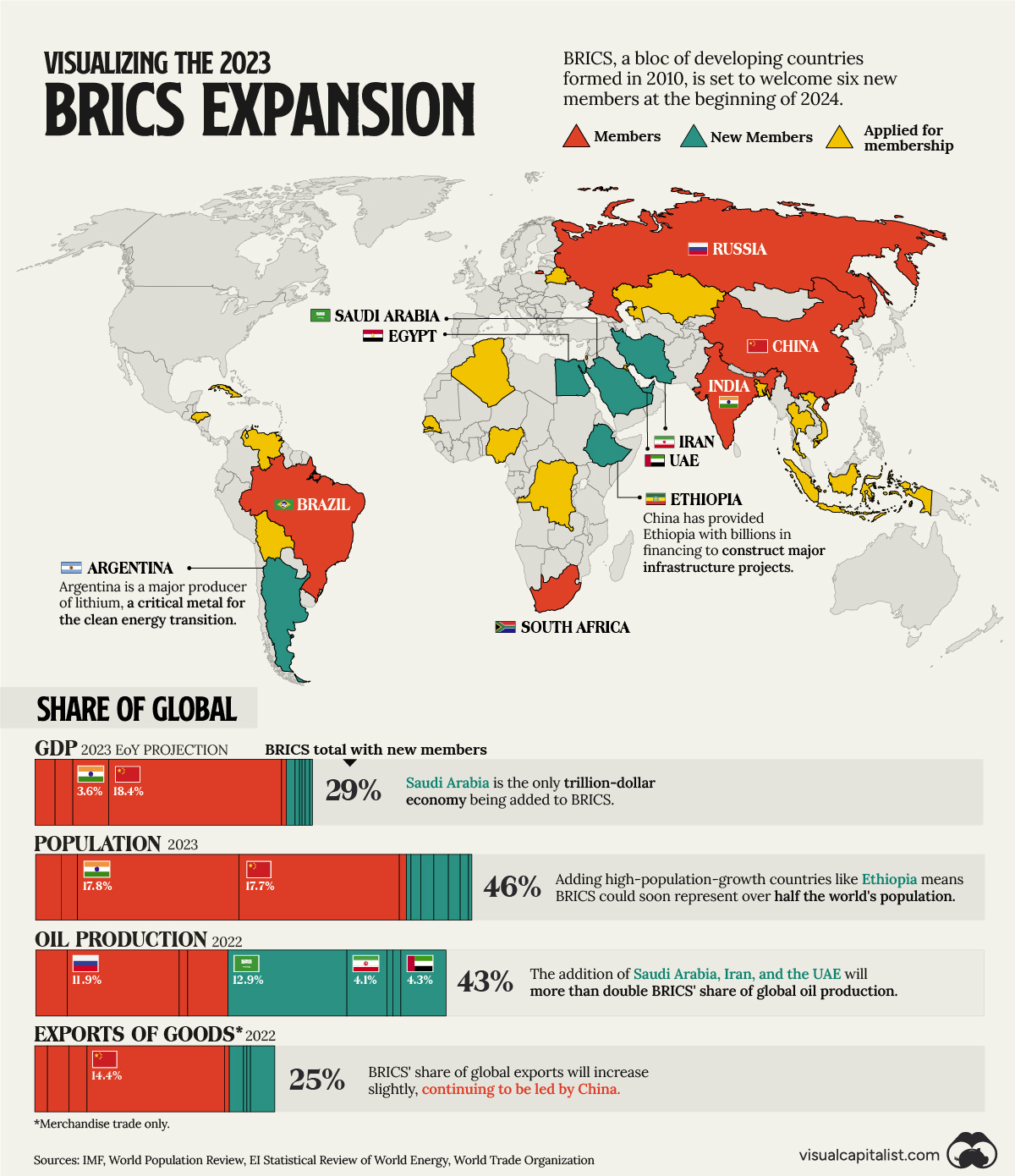

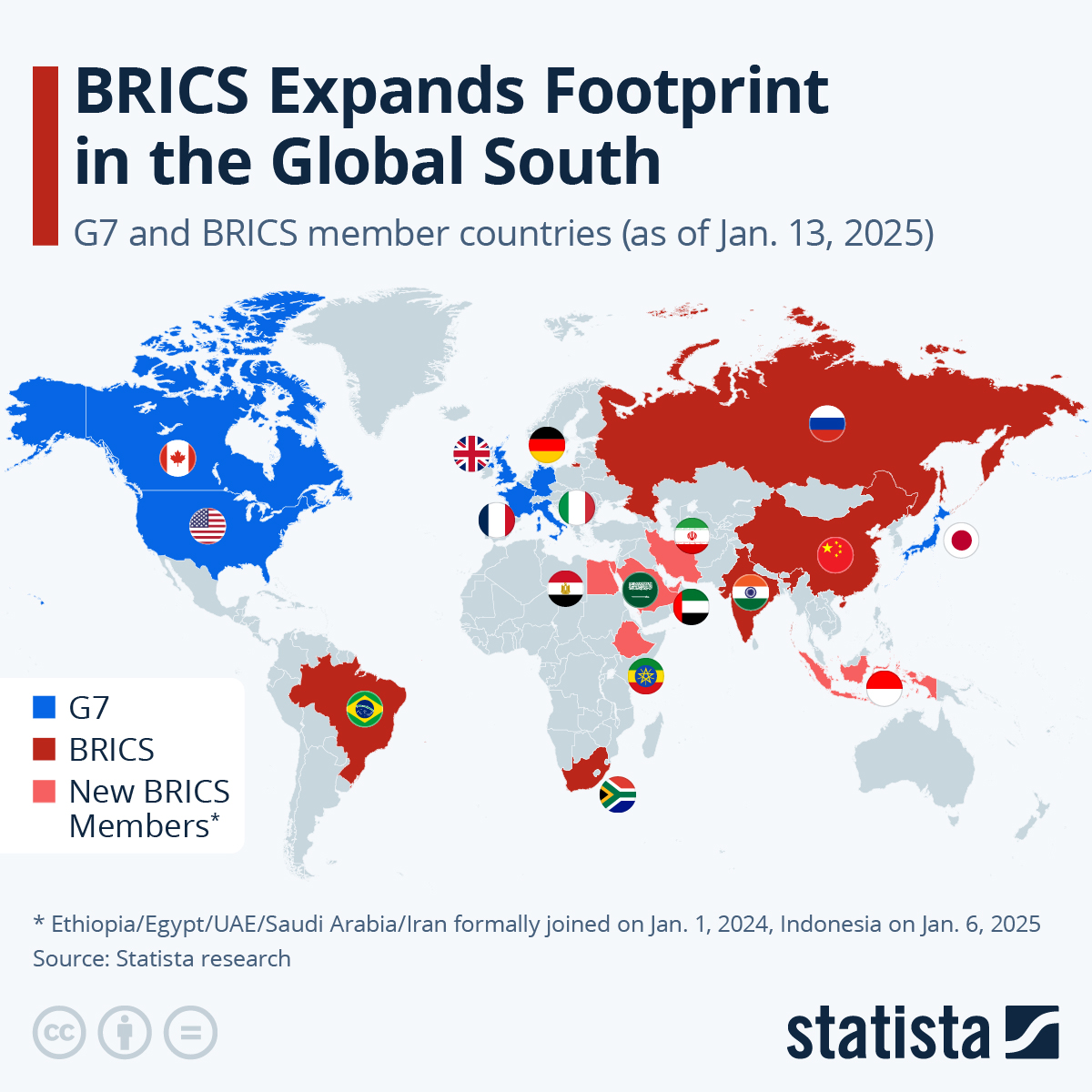

Brics is expanding rapidly and more countries are avoiding the dollar entirely

And central banks are buying record amounts of gold instead of US reserves followed by Oil De-dollarization preparing for the crash . Already made a thread about this topic

looksmax.org

looksmax.org

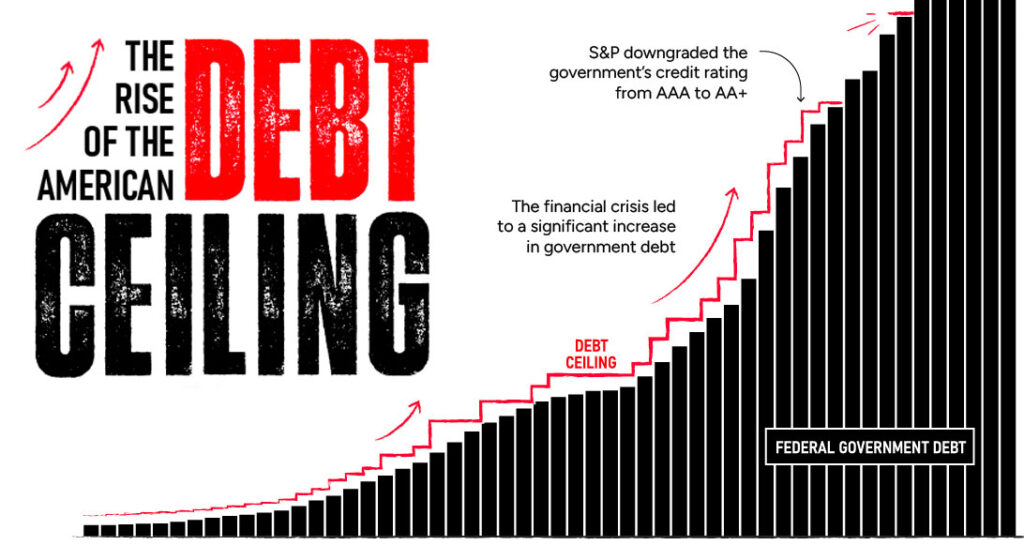

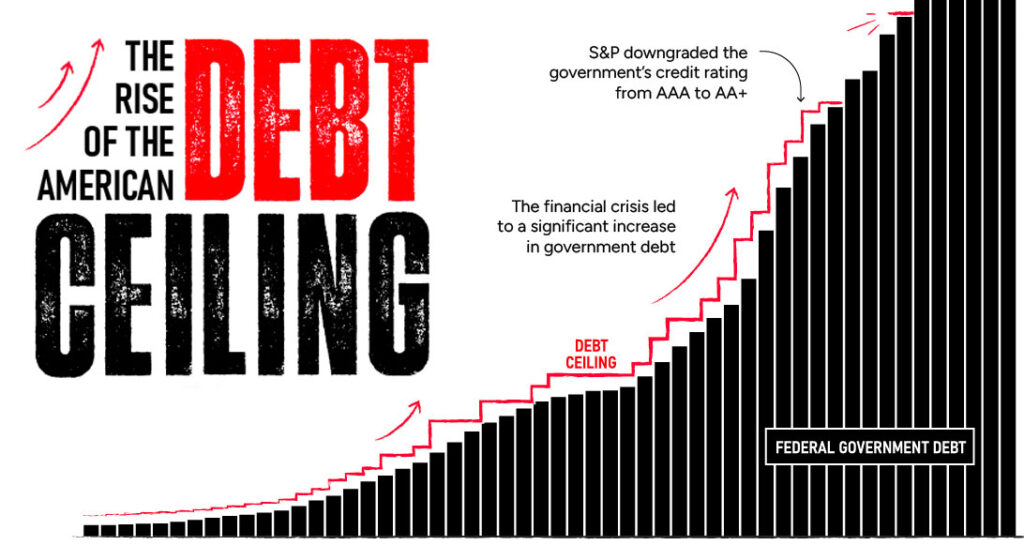

Part of what is preventing this from happening is U.S 's massive economy but the problem isn't the economy it's debt. Like I explained in my previous threads above.

U.S debts hit a record high in a century and they keep rising and trump being in office isn't helping it as the confidence in the dollar is breaking. If trust falls too fast. The gap falls too fast then the world economy could be in shambles as the world runs on the U.S dollar and there's no real replacement ready.

Linking a video of detailed analysis from an economist if you are interested.

So what can you do? The Lifeboat Strategy. A brilliant book written by Mark nestmann that exactly explains what to do to safe guard your wealth in these kind of situations. I highly recommend giving it a read

As Mark Nestmann outlines in The Lifeboat Strategy, when the Titanic of the U.S. financial system hits the iceberg those who survive are the ones who prepared their exit long ago.

Key Takeaways from the book

-Jurisdictional Diversification: Don't keep your life, your business, and your money in one country. Always have a Plan B residency or citizenship to avoid being trapped by capital controls or civil unrest.

-Asset Internationalization: Move wealth into hard jurisdictions like Switzerland or Singapore. I already mentioned this in my previous thread but invest in gold gold and silver outside the U.S. banking system

-Financial Privacy: Use legal structures like offshore LLCs or trusts to stay under the radar. In a crisis desperate governments target the most visibly wealth first.

The next 5–10 years arr going to be volatile and will be defined by the grim reality of currency resets and the rise of BRICS. Whether Trump’s policies accelerate it or he comes to his sense and tries to fight back. The math of the debt remains undefeated. It is time to build your lifeboat now.

The unstoppable dollar meets the immovable Mr Trump

Dollar cycles are longer than others because four self-reinforcing forces create inertia. They rarely reverse unless all four turn at once. Trump-era policies, fiscal strain and shifting global capital could trigger such a convergence.

The dollar’s Super Cycle and the End of Economic Primacy - Trader Summit

The US Dollar is in the third major rally since the end of Bretton Woods. There was the Reagan-Volcker Rally, the Clinton-Rubin rally and now the Obama-Trump rally. In my first book "Making Sense of the Dollar", published between the Bear Stearns demise and the fall of Lehman Bros, I anticipated...

It has dominated and been the definitive currency of world trade for almost a century now but everyone's now quitely preparing for life after it. In a few years it might be the end of it because of Mr. Trumps brilliant policies

Brics is expanding rapidly and more countries are avoiding the dollar entirely

And central banks are buying record amounts of gold instead of US reserves followed by Oil De-dollarization preparing for the crash . Already made a thread about this topic

Why gold is important to have explained by yours truly

Since you niggas like my stock market analysis threads so much let's make another one that is a fairly obvious but important phenomenon that is happening rn which makes for a good case study. Everyone rn is hoarding on gold. Gold went up by 50% this year...

Part of what is preventing this from happening is U.S 's massive economy but the problem isn't the economy it's debt. Like I explained in my previous threads above.

U.S debts hit a record high in a century and they keep rising and trump being in office isn't helping it as the confidence in the dollar is breaking. If trust falls too fast. The gap falls too fast then the world economy could be in shambles as the world runs on the U.S dollar and there's no real replacement ready.

Linking a video of detailed analysis from an economist if you are interested.

So what can you do? The Lifeboat Strategy. A brilliant book written by Mark nestmann that exactly explains what to do to safe guard your wealth in these kind of situations. I highly recommend giving it a read

As Mark Nestmann outlines in The Lifeboat Strategy, when the Titanic of the U.S. financial system hits the iceberg those who survive are the ones who prepared their exit long ago.

Key Takeaways from the book

-Jurisdictional Diversification: Don't keep your life, your business, and your money in one country. Always have a Plan B residency or citizenship to avoid being trapped by capital controls or civil unrest.

-Asset Internationalization: Move wealth into hard jurisdictions like Switzerland or Singapore. I already mentioned this in my previous thread but invest in gold gold and silver outside the U.S. banking system

-Financial Privacy: Use legal structures like offshore LLCs or trusts to stay under the radar. In a crisis desperate governments target the most visibly wealth first.

The next 5–10 years arr going to be volatile and will be defined by the grim reality of currency resets and the rise of BRICS. Whether Trump’s policies accelerate it or he comes to his sense and tries to fight back. The math of the debt remains undefeated. It is time to build your lifeboat now.

Last edited: