letitsnow_

Iron

- Joined

- Apr 22, 2024

- Posts

- 72

- Reputation

- 77

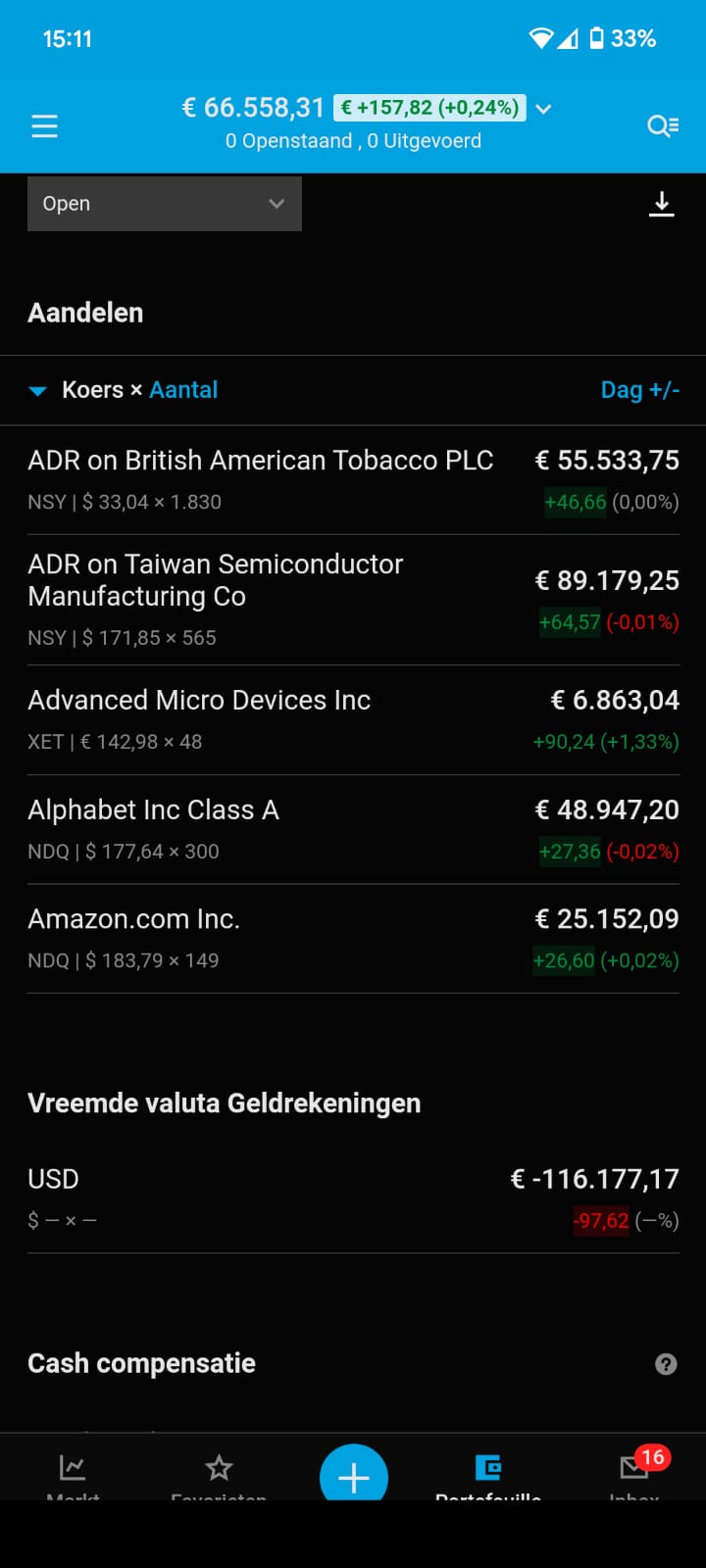

sadly too high iq for memy stock market debt-interest payments are covered by my stock market gains.

They put my account negative 900 dollars due to interest payments for month June. But since my investments went up, this is irrelevant.

This negative 900 dollars fits into my leverage ratio. It doesn't need to be paid, it's simply considered as additional leverage which is fine as long as my stock keeps going up.