I

imjustcookedfr

Bronze

- Joined

- Dec 27, 2024

- Posts

- 279

- Reputation

- 142

Sup guys, I’m back on .org after being away for a while. One of the biggest things I struggled with before was making money, but since then I’ve discovered a few low-risk, high-reward methods that actually work.

Using the method I’m about to talk about, I’ve made almost $6,000 since April. My profit margin is around 50%, which might not sound insane, but keep in mind I started with a relatively small amount of capital. I began with about $12,000, and now I’m sitting at roughly $17.5k.

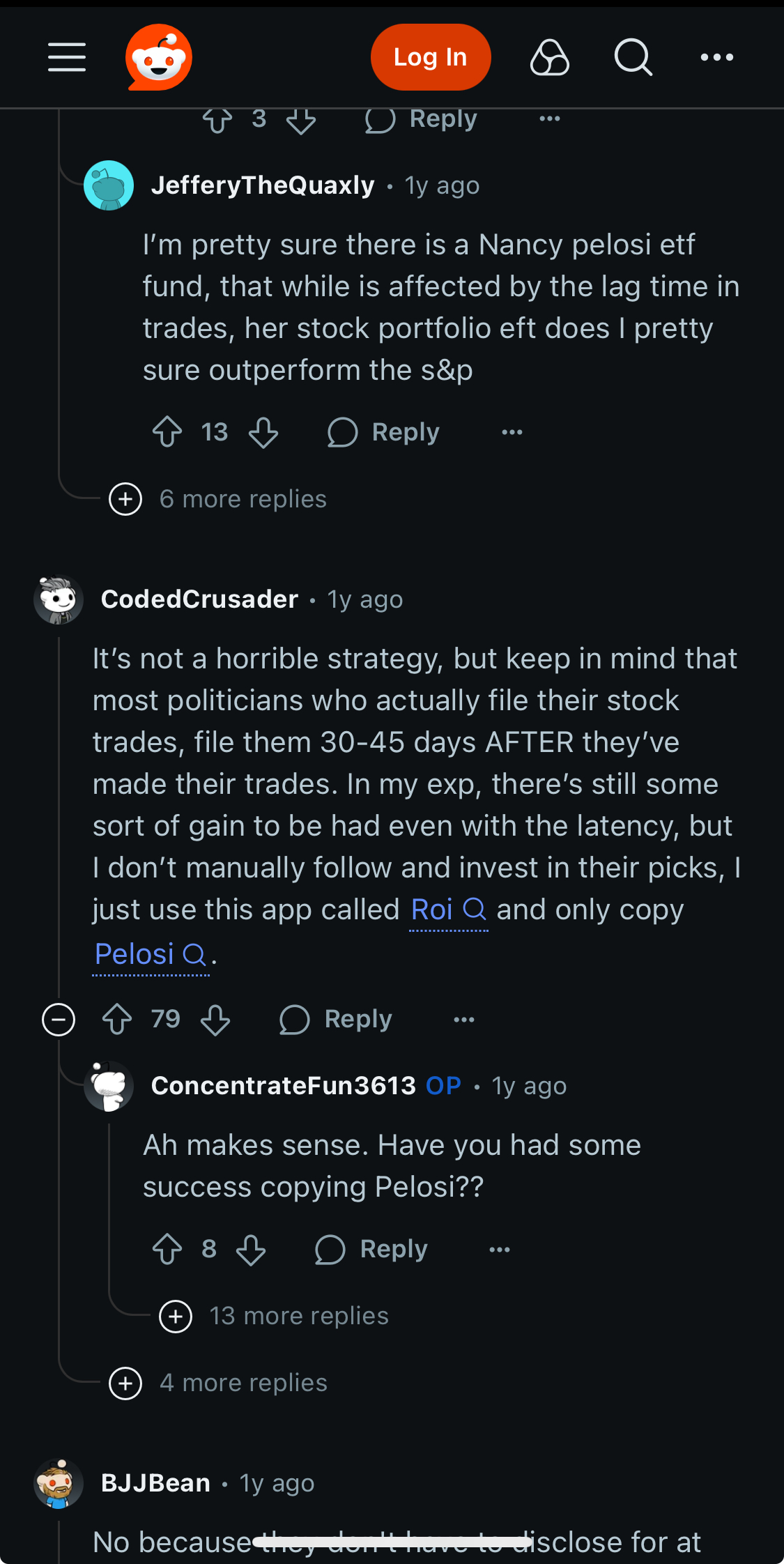

What I’m talking about here is trading by tracking insider activity. basically following the moves of higher-ups in companies (ceos, cfos, etc....) as well as certain politicians. I am now sure we all heard about Nancy Pelosi being a better trader than Warren Buffett.

How to get started:

First of all, please don’t go on TikTok and search “copying insider traders.” those guys are just trying to sell you signals, you are the method jfl.

If you’re serious, you’ll need to do your own research. Two really useful free tools are:

http://openinsider.com/

https://www.marketbeat.com/insider-trades/

On these sites, you can track purchases made by high-ranking executives and politicians. The real jackpot is when you see multiple insiders buying the same stock around the same time. this often signals strong confidence and most probably few people have some inside knowledge.

Example from my own trades:

One of my best wins came from Barrick Gold Corp. A while back, the stock took a huge dip, but I noticed several politicians quietly loading up on it. I bought in heavy during that dip, and once prices stabilized, I walked away with about $2k in profit.

Tomorrow, they’re releasing their Q2 earnings report. I’m expecting a small dip after that, so I’ve already put in another $350, and if the price drops further, I’ll double down. The company is still massively undervalued in my opinion, so I’m happy to hold.

That’s just one example—there have been others. The main thing is to stay patient, watch the patterns, and remember: insiders aren’t buying for no reason.

Using the method I’m about to talk about, I’ve made almost $6,000 since April. My profit margin is around 50%, which might not sound insane, but keep in mind I started with a relatively small amount of capital. I began with about $12,000, and now I’m sitting at roughly $17.5k.

What I’m talking about here is trading by tracking insider activity. basically following the moves of higher-ups in companies (ceos, cfos, etc....) as well as certain politicians. I am now sure we all heard about Nancy Pelosi being a better trader than Warren Buffett.

How to get started:

First of all, please don’t go on TikTok and search “copying insider traders.” those guys are just trying to sell you signals, you are the method jfl.

If you’re serious, you’ll need to do your own research. Two really useful free tools are:

http://openinsider.com/

https://www.marketbeat.com/insider-trades/

On these sites, you can track purchases made by high-ranking executives and politicians. The real jackpot is when you see multiple insiders buying the same stock around the same time. this often signals strong confidence and most probably few people have some inside knowledge.

Example from my own trades:

One of my best wins came from Barrick Gold Corp. A while back, the stock took a huge dip, but I noticed several politicians quietly loading up on it. I bought in heavy during that dip, and once prices stabilized, I walked away with about $2k in profit.

Tomorrow, they’re releasing their Q2 earnings report. I’m expecting a small dip after that, so I’ve already put in another $350, and if the price drops further, I’ll double down. The company is still massively undervalued in my opinion, so I’m happy to hold.

That’s just one example—there have been others. The main thing is to stay patient, watch the patterns, and remember: insiders aren’t buying for no reason.